Germany retains top position in the Intrum Financial Wellbeing Barometer

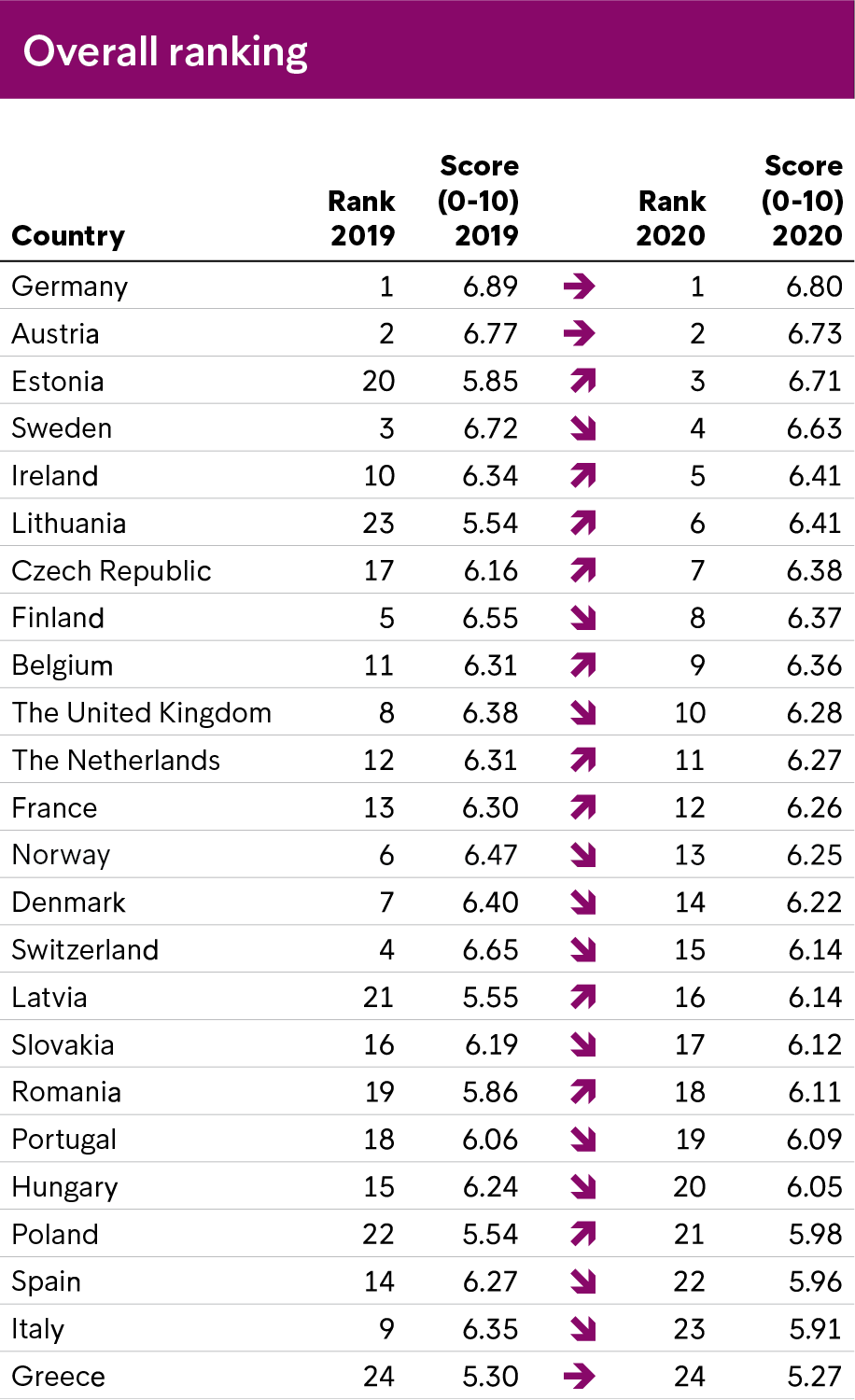

The Intrum Financial Wellbeing Barometer – now in its second year – compares and tracks the financial health of consumers across 24 European countries. Despite ongoing constraints to economic activity in Germany due to Covid-19, the country has held on to the top ranking in this year’s Barometer.

Germany retains top position

Despite ongoing constraints to economic activity in Germany due to Covid-19, the country has held on to the top ranking in this year’s Barometer.

Stimulus measures and job protection schemes appear to have shielded household incomes and enabled consumers to continue paying their bills on time. Moreover, German consumers are reputed for their pragmatic spending and focus on saving, which is reflected in the country’s top ranking for the Saving for the future pillar.

It is evident that households in countries that already suffered from financial instability and high unemployment rates going into the pandemic have been worse off in terms of financial health. The past year has stressed the importance of having a financial safety net, and in 2021, it is vital that households take additional measures to better manage their personal financesAnette Willumsen, Managing Director CMS Sales & Service Development and Markets at Intrum.

Southern Europe is struggling

Meanwhile, the pre-existing household debt and financial instability of consumers in Southern Europe has been aggravated by Covid-19, and countries including Italy, Spain and Greece have fallen in this year’s rankings.

Italy’s economy was already performing weakly at the end of 2019 and heavy contractions in employment levels between April and May 2020 hit incomes hard. This has hampered consumers’ ability to pay their bills on time and save – and has seen the country slide 14 places on our Barometer this year.

Spain’s workforce relies heavily on tourism, but the industry has been devastated by Covid-19, and infection rates are higher in the country than anywhere else in Europe at the time of writing. As a result of worsening unemployment, consumers’ ability to save for the future has been hampered. Combined with declines in respondents’ financial literacy performance, the fall in savings sees the country fall eight places on the Barometer.

Greece, whose unemployment rate is the highest in Europe and whose household net savings rate stood at -15.1 per cent in 2018 (the lowest in Europe), is a non-mover at the bottom of the rankings, scoring poorly on consumers’ ability to pay bills on time and save for the future.

Baltics rising

The Baltic countries have weathered the Covid-19 crisis better than expected and made strong gains in this year’s Barometer.

Restrictions on economic activity have had a significant impact on consumption and employment levels, but relatively low household debt-to-income ratio across all Baltic countries combined with a strong financial literacy performance means consumers from this region are better placed than many to bounce back financially from the Covid-19 crisis. It is worth noting that the Baltic countries’ rise up the financial literacy rankings also reflects an adjustment in the sample profile for these countries since 2019.

Restrictions on economic activity have had a significant impact on Estonia’s consumption and employment levels, but investment in its digital infrastructure and a relatively low household debt-to-income ratio will help its consumers bounce back financially from the crisis.

Our research suggests that it is easier for some to achieve financial security than others due to individual financial circumstances and the broader macroeconomic landscape. There is no silver bullet, but nonetheless, with financial education and guidance from both public institutions as well as financial services firms, consumers are enabled to make better decisions when it comes to one’s personal financesAnette Willumsen, Managing Director CMS Sales & Service Development and Markets at Intrum.

Are you interested to learn more about how Covid-19 has impacted consumers in your country?

Download the European Consumer Payment Report 2020:

About the Intrum Financial Wellbeing Barometer

The Intrum Financial Wellbeing Barometer is a tool to measure and easily compare the Financial Wellbeing of European Consumers across 24 European markets. We term ‘Financial Wellbeing’ as having the financial security to meet everyday spending needs and be in control of your finances.

The barometer presents an overall financial wellbeing score for each country – an aggregate ranking that combines scores (1–10) across three pillars, including calculations that considers key indicators relating to consumers‘ debt-to-income ratio. We previously included a fourth pillar, for Credit freedom, but have removed it from this year’s research while retaining the Barometer’s underlying methodology.

1. Ability to pay bills

The level at which consumers are able to pay their bills on time, the proportion of their salary they have remaining once their monthly bills are paid (survey-based indicators), and the gross disposable household income per capita (hard data).

2. Saving for the Future

The level that consumers are able to save each month, their ability to save for an unforeseen event (survey-based indicators), and the gross household saving rate (hard data).

3. Financial Literacy

The extent to which consumers understand basic financial terms and calculations (survey-based indicators).