Social media becoming important source of financial education among the young

European Money Week 2021: Intrum’s latest consumer survey shows that there’s a generational shift underway in how consumers attain their financial knowledge; one in five (20%) of 18-21 year olds say social media is their primary source of information.

One year into the pandemic, it is an understatement to say that it has changed everyday life for all of us. The financial consequences of Covid-19 are vast and will have long-term implications for individuals, businesses and society.

Findings from our latest European Consumer Payment Report shows that European's are taking action to meet the economic downturn:

- 46% of 18-21-year-olds are taking steps to deepen their financial knowledge. 37% of those aged 55 to 64 say the same.

- Nearly half (47%) of all respondents to the report indicate that financial security has become a key personal goal

We see an increase of consumers turning to online content as a primary source for financial educationInsights from the European Consumer Payment Report 2020

Online sources on the rise

A key trend that has been emerging in recent years is the increasing prominence of the internet in our daily lives. And the restrictions of the pandemic have meant more and more people have turned to online content for their information needs over the past 12 months.

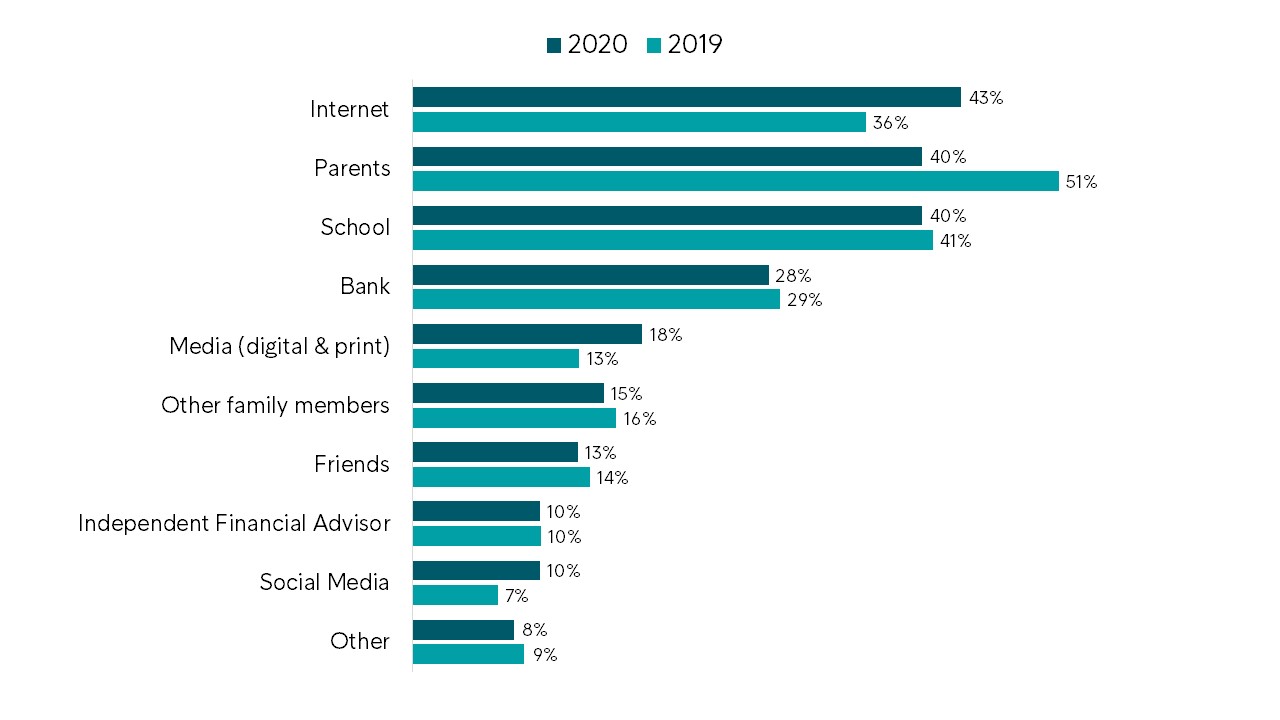

Intrum’s 2020 European Consumer Payment Report shows a significant increase in the role of the internet with regard to financial education, compared with just a year ago.

Q: Over the course of your lifetime, what have been your primary sources of financial education? (European average, year on year)

Generational shift

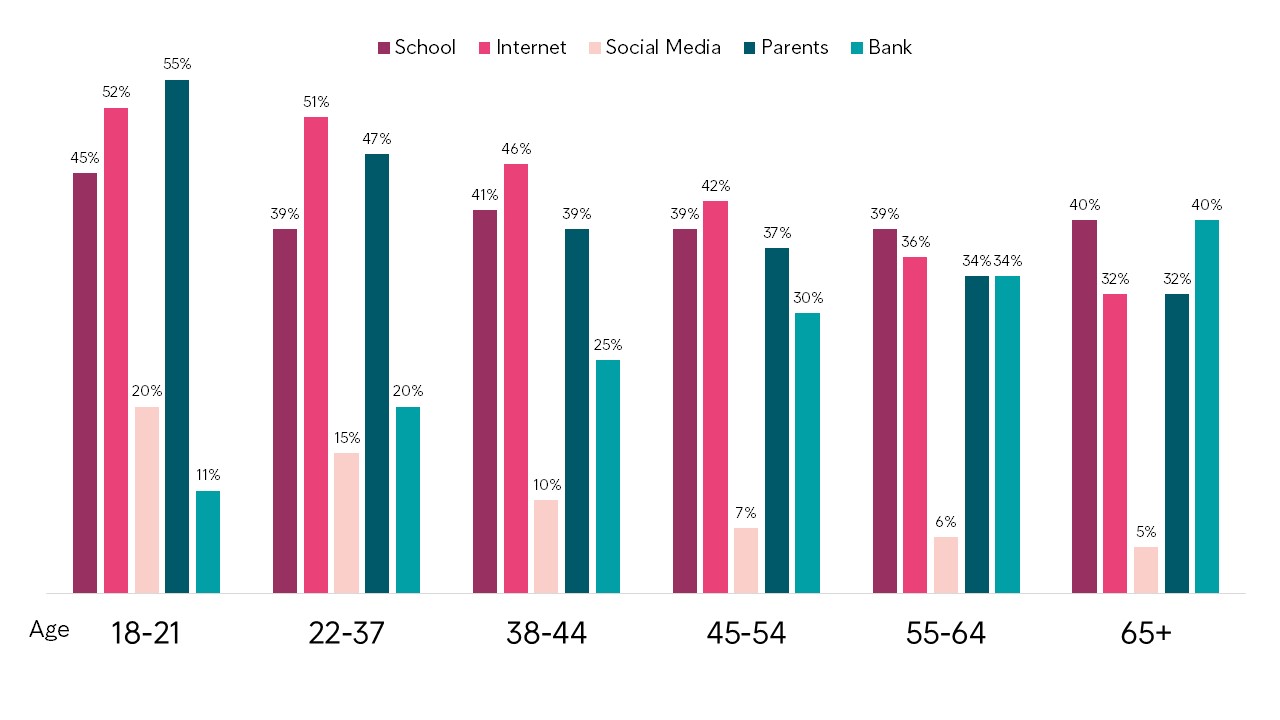

Among younger consumers, digital sources are increasingly replacing traditional resources such as banks, parents, financial advisers and financial newspapers.

Four in ten Europeans aged 65 and above say their main financial education came from their bank, whereas 52% of those under 40 years old look to the internet. Overall, 43% of consumers say the internet is their main resource, compared with 36% in 2019.

Q: Over the course of your lifetime, what have been your primary sources of financial education? (top 5 sources, split by age groups)

Financial knowledge more important than ever

Access to financial education and possessing skills to make wise financial decisions will be key for individuals to meet the challenges posed by the Covid-19 pandemic.

Founded in 1923, we at Intrum have a long history in helping customers to navigate financial downturns. In today’s challenging environment, we aim to empower businesses and consumers alike with our expertise and solutions. In this way, we will help to rebuild sound economies across Europe.