These are the precautions European companies take against late payments

Pre-payment and credit checks top the list, but some take no preventative measures at all

Late payments are a fact of life for every business, but they can have a serious effect on small and medium-sized enterprises (SMEs), harming their ability to pay employees and suppliers, cover operating costs, and pursue growth opportunities.

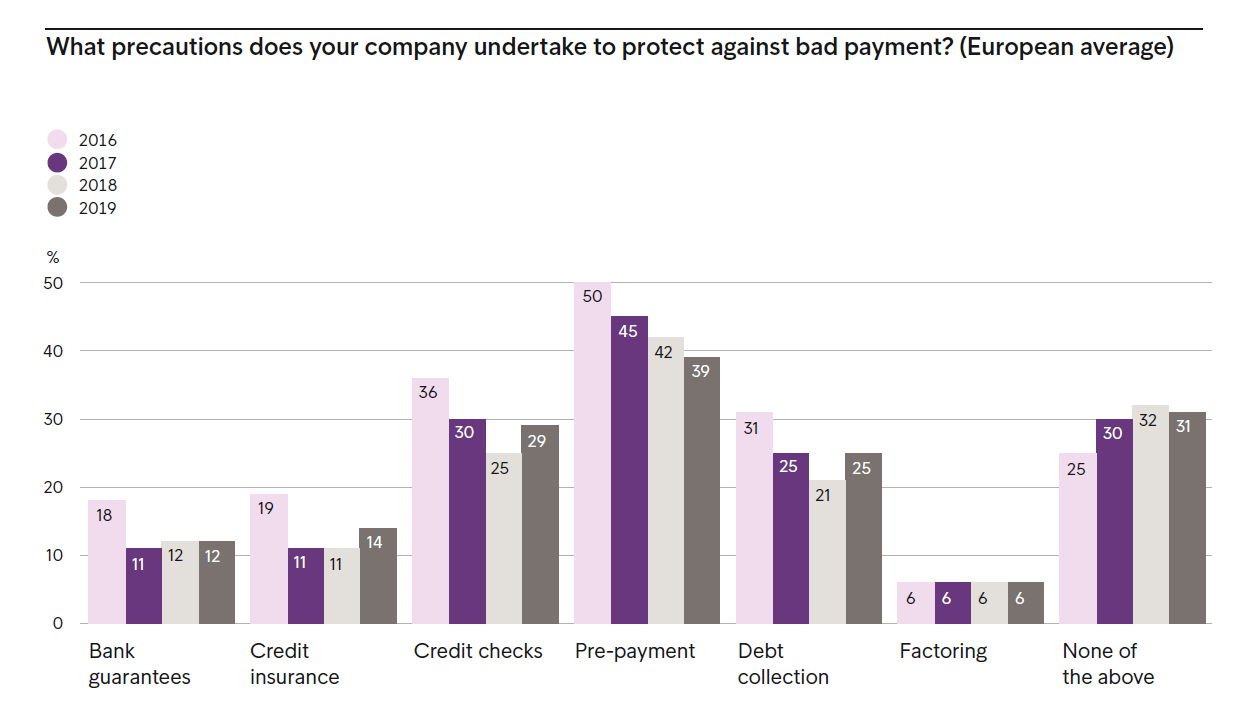

The European Payment Report 2019 by Intrum finds that many companies, large and small, use pre-payment for the goods or service or run credit checks to screen customers who are at a high risk of defaulting or use a debt collection agency. But as many as 31% of European businesses say they take none of the standard preventative measures to protect their business.

Pre-payment still common, especially in eastern countries

Across Europe as a whole, pre-payment is still the most common approach companies take to protect themselves. On average close to two in five (39%) European companies say they use pre-payment against late payments.

However, there are clear regional differences:

- In Eastern Europe, the pre-payment average is 52%; the highest among any of the European regions. In countries such as Serbia (65%), Romania (58%) and Poland (57%), paying up front still seems to be standard business practice.

- In Southern Europe, the overall pre-payment average is just 30%, and in Spain just 19% of companies do business this way. The outlier here is Greece, where more than three in five (64%) of Greek companies use pre-payment as protection.

- 40% of companies in both Central Europe and Northern Europe use pre-payment, though in both cases the figures vary widely.

- In Central Europe, it ranges between 30% in Hungary and 55% in Switzerland.

- In Northern Europe, just 35% use pre-payments in Austria, Finland and Sweden, but 49% of Norwegian businesses do so.

Overall, 39% of SME’s across Europe use prepayment as precautions for late payments, and for larger companies (with more than 250 employees) 45% use the alternative. However, there has been a downward trend over the past three years; from 50% in 2016.

Debt collection and credit checks – regional divides

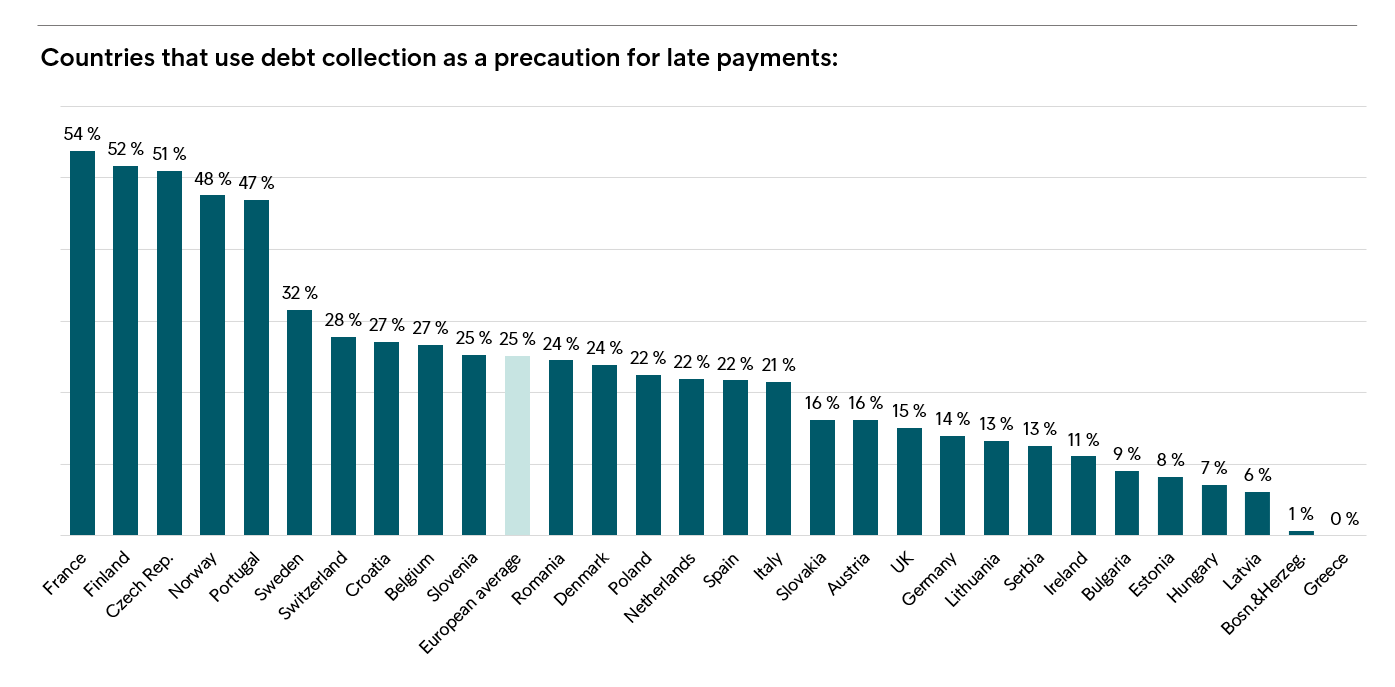

There is also a regional divide over using debt collection services and, in the case of Eastern Europe, when it comes to using credit checks. A third of companies (33%) in Northern Europe say they use debt collection as a precaution, but in Eastern and Southern Europe less than a quarter (23%) do so.

Looking by individual country, just 1% of businesses in Bosnia and Herzegovina use a debt collection service because factoring (selling the debt to a third-party) is much more common (44%).

Significantly more large companies in Europe turn to debt collection (42%) than the average for SMEs (24%).

Credit checks of potential customers can minimise the risk of bad debts. Close to one in three (29%) of European companies use this screening approach to understand the risks related an individual customers, thus avoid the possibility of granting credit to customers that are more likely to default.

Other measures, or none of the above

Credit insurance, bank guarantees, and factoring are other ways to companies use to protect their businesses, though they are much less popular in Europe than the likes of pre-payment or credit checks, and companies have been using them less and less in recent years.

Intrum also finds that 31% of European companies take none of the above-mentioned measures against late payment or payment default. As many as 58% of Hungarian firms, 50% of Estonian companies and 47% of UK businesses have no such precautions; Austria (40%), Latvia (47%), Lithuania (43%) and Sweden (34%) prove that this issue isn’t specific to one region.

For those trying to keep their business going and even growing, it can be daunting to deal with the issue of late payments in a customer-sensitive but decisive manner. However, help and advice are available.

Help and advice are available

A successful business depends on predictable cash flow and good customer relationships. When your customers fail to pay on time, Intrum can collect the debt, while minimising the impact on the customer relationship. We service around 80,000 firms, our clients, to grow by caring for their customers. Read more about our business solutions here.

To find out more

All the results are published in Intrum’s European Payment Report (EPR) 2019. The report is based on a survey of 11,856 companies in 29 European countries.