Sustainability at Intrum

As a major provider of credit management services, Intrum plays an important role in the financial ecosystem. We aim to create sustainable economic conditions for people and businesses, leading the way to a sound economy and benefiting society as a whole.

Given our position and size, it is our responsibility to drive the development of a sustainable debt collection industry. Three areas of sustainability drive our work: enabling sustainable payments, being a trusted and respected actor, and growing by making a difference.

These are closely related to our identity and are integrated into the day-to-day operations. They incorporate the 10 principles of the UN Global Compact, of which Intrum has been a signatory since 2016.

Each focus area is also linked to selected Sustainable Development Goals (SDGs) and targets within the United Nation’s Agenda 2030.

Intrum’s sustainability strategy

Enabling sustainable payments

By ensuring sustainable payment flows between companies and individuals, we fill an important function in society. Companies can flourish and grow, while consumers have sufficient knowledge to make well-founded decisions and comfortably manage their finances. This benefits society as a whole.

As a market leader, setting the standard for our industry and leading the way in sustainable future business practices is both an opportunity and a responsibility. We choose our clients with care and co-operate with companies that share our values of good business ethics.

Intrum has extensive experience in helping people become debt free, and we act considerately and respectfully towards people in each individual financial situation. We are happy to share our expertise and work pro-actively and continuously to spread knowledge about private finances and counteract over-indebtedness.

We work at EU level to increase awareness of credit management and payments as well as raising understanding of financial literacy through targeted education initiatives.

Being trusted and respected

Our vision is to be trusted and respected by everyone who provides and receives credit. Every day, our clients entrust us with their most important asset – their customers. As well as complying with laws and regulations, we live and breathe our values Empathy, Ethics, Dedication and Solutions, striving to meet the highest standards in everything we do.

Growing by making a difference

With a presence in 20 European markets and around 10,000 employees, we are market leaders in terms of revenue, geographical spread and workforce size. We want to offer a meaningful and stimulating workplace and strive to be the most attractive employer in our sector. Our position also allows us to drive the development of the entire industry in a more ethical direction, thereby creating value and meaning for our employees.

We see diversity as an important asset for our capacity to be responsive, to understand the individual situation of each person, and to help people get out of debt. In our day-to-day work, we listen actively and do our utmost to understand people, treating them with dignity and respect. This applies to us both internally and in our contact with customers, clients and other stakeholders.

Sustainability goals

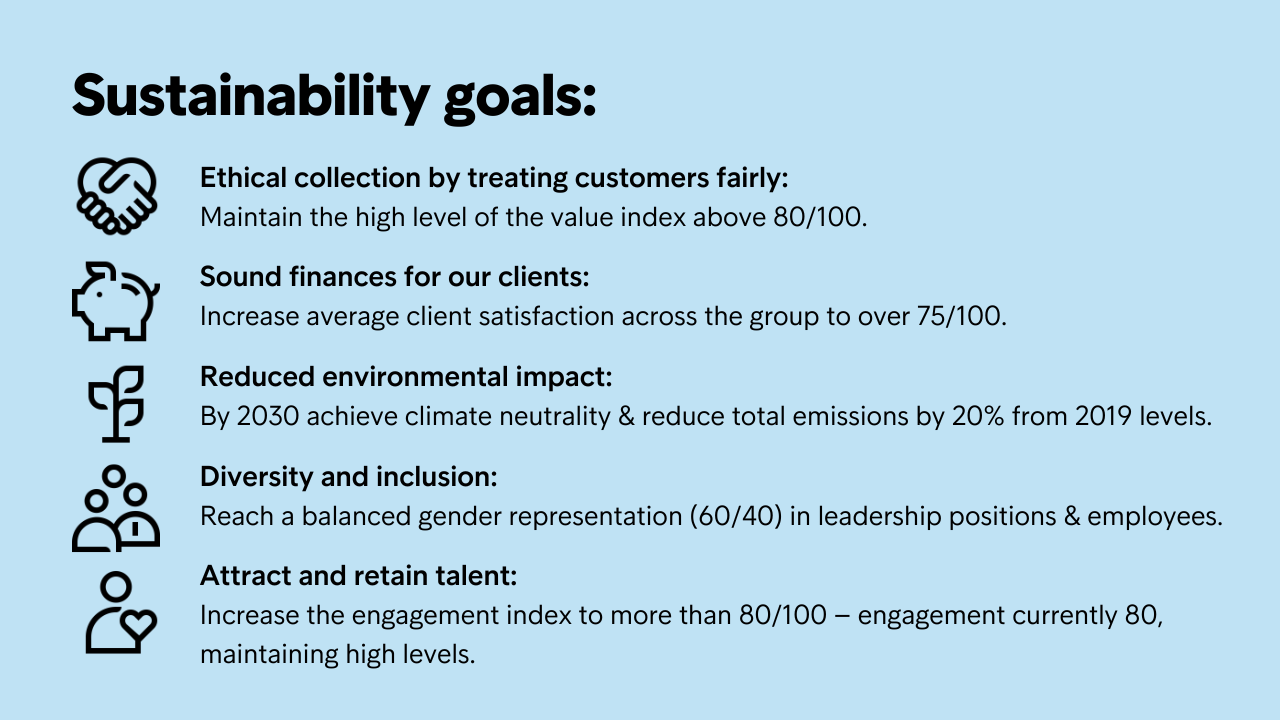

Incorporating input from our key stakeholders as well as our commitment to various sustainability frameworks, in 2020 we announced five sustainability goals, four to be reached by 2023 and a reduction target to be realised by 2030.

Ethical collection by treating customers fairly:

Treating our customers ethically and fairly promotes their wellbeing and safeguards the reputation of our clients. We strive to understand each individual situation, helping our customers resolve their debt and reintegrate into the financial system. Our global harmonised customer satisfaction survey, high level of training and stringent internal processes measure the success of this.

Goal: Maintain the high level of the value index above 80/100 – this currently sits at 85. In 2022 alone, around 4 million customers became debt free with Intrum.

Sound finances for our clients:

Ensuring that companies receive their payments on time is critical for their liquidity needs, securing a well-functioning financial ecosystem. Every year we support 80,000 companies across Europe, the vast majority of which are small and medium-sized organisations. Our work frees clients to focus on their core business. We run regular surveys to gauge client views.

Goal: Increase average client satisfaction across the group to over 75/100 – client satisfaction is currently 76. In 2022, we generated 89 billion SEK to our clients by acting as agent and buying portfolios – and thus released from their balance sheets.

Reduced environmental impact:

As a large multinational company we need to act to reduce our impact on the environment. We measure our climate footprint within scope 1, 2 and 3 of the Greenhouse Gas Protocol.

Goal: By 2030 achieve climate neutrality and reduce total emissions by 20% from 2019 levels. Our emissions have decreased by -10% in total compared to the baseline year 2019 from 7,277 tonnes to 6,551 tonnes.

Attract and retain talent:

Attracting and retaining talent is vital for the long-term success of our business. Our capacity to do this goes hand in hand with employee wellbeing. We strive to provide a meaningful and stimulating workplace. For some, working at Intrum is an entry-level job, for others their next career step. Our initiatives include internal mobility and career opportunities as well as employee wellbeing and engagement programmes.

Goal: Increase the engagement index to more than 80/100 – engagement currently 80 in line with target.

Diversity and inclusion:

A diverse workforce enables us to respond to client and customer needs as well as feeding in new ideas and developing our business.

Goal: Reach a balanced gender representation (60/40) in leadership positions and employees. Board of directors Women 38%, Men 62% GMT Women 31%, Men 69%.

Sustainability Ratings

Carbon Disclosure Project (CDP)

Scores companies on a scale from A-D based on management of climate related risks and opportunities, and disclosure and towards environmental leadership.

Sustainalytics ESG Risk rating

A Morningstar company. Rating companies’ exposure to material, industry-specific ESG risks and an the management of those risks. Rating scale 0–10 negligible, 10–20 low, 20–30 medium, 30–40 high, 40+ severe.

The 2022 score places Intrum in the top 10% of all 15 349 rated companies, and top 8% of 856 rated companies in the industry diversified financials (as per May 2023).

| 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|

| 14.7 | 14 | 12.8 | 18.9 |

Morgan Stanley Capital International (MSCI)

Measures a company’s exposure to financially relevant ESG risks and opportunities, and the management of those risks relative to peers. Rating scale AAA-CCC.

Sustainability frameworks

UN Global Compact

We have been a signatory of the United Nations Global Compact since 2016. This is the world’s largest sustainability initiative among companies. As a signatory, we have committed to implement the ten principles on human rights, labour rights, environment and anti-corruption into our business.

UN Sustainable Development Goals

We have also aligned with the United Nations Agenda 2030 and the Sustainable Development Goals. We consider all goals to be important, and we have selected three goals where we see high potential to contribute: Goal five – Gender equality, Goal eight – Decent work and economic growth and Goal 13 – Climate action.

The Task Force on Climate Related Financial Disclosure (TCFD)

TCFD was created to develop a set of recommendations for voluntary climate-related financial disclosures for use by companies in providing information to investors, lenders, insurers, and other stakeholders. We declared our support for the initiative in 2021 and are continuously aligning with the reporting recommendations.

UN Guiding Principles on Businesses and Human Rights

In January 2021, we conducted our first Human Rights Impact Assessment, applying the UN Guiding Principles Framework to identify the most salient human rights risks connected to our business.

This article was last updated in July 2023. We strive to continuously update with the latest figures and data. Get in touch if you have any questions or comments.