A widening payment gap threatens business growth

Against a backdrop of economic uncertainty, the payment gap – the time between the agreed payment term and the actual duration of pay – is widening

A pandemic-related recession will continue to have a dramatic impact on the European payments landscape. Decreased revenues have reduced cash flow and increased pressure on outgoing payments.

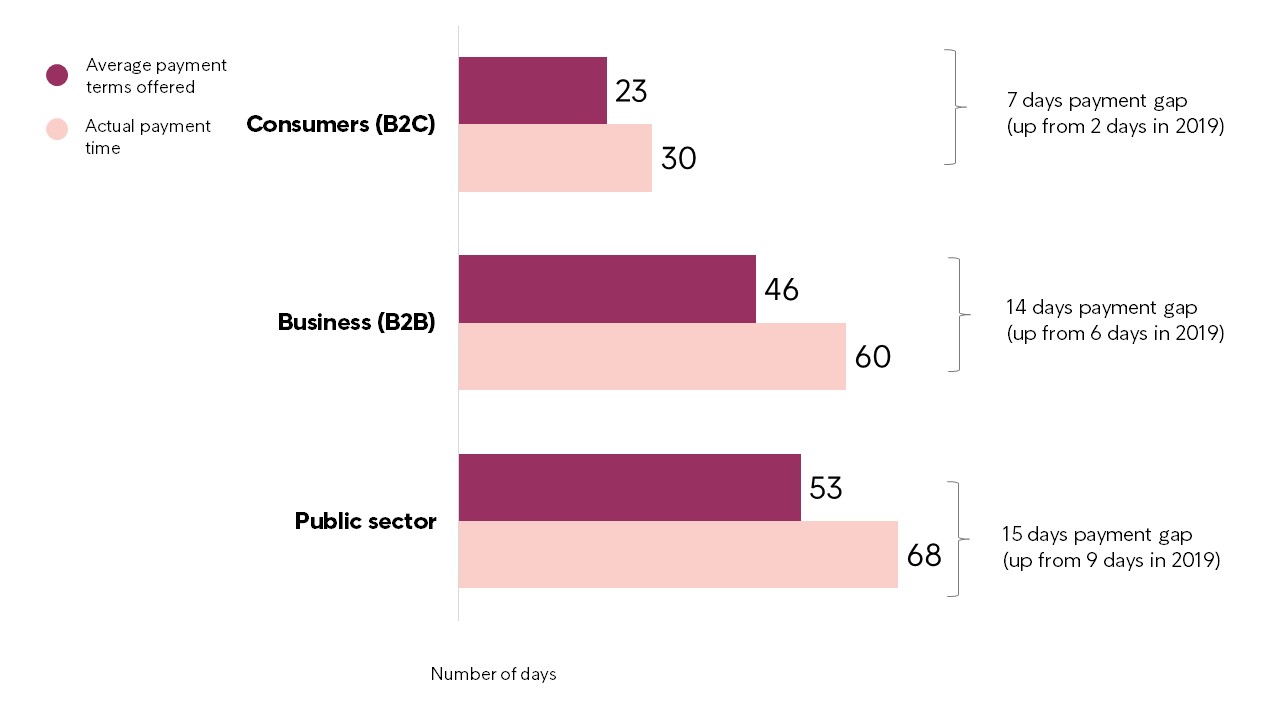

Our survey shows that the payment gap is widening, particular in B2B corporate payments. In 2019 the payment gap was 6 days, in 2020 it has increased to 14 days. The same tendency is seen in public sector, with an increase of payment gap from 9 days in 2019 to 15 days in 2020.

Gap in payment terms offered and actual payment duration (in days):

A widening gap is a risk to the sustainable growth of European businesses

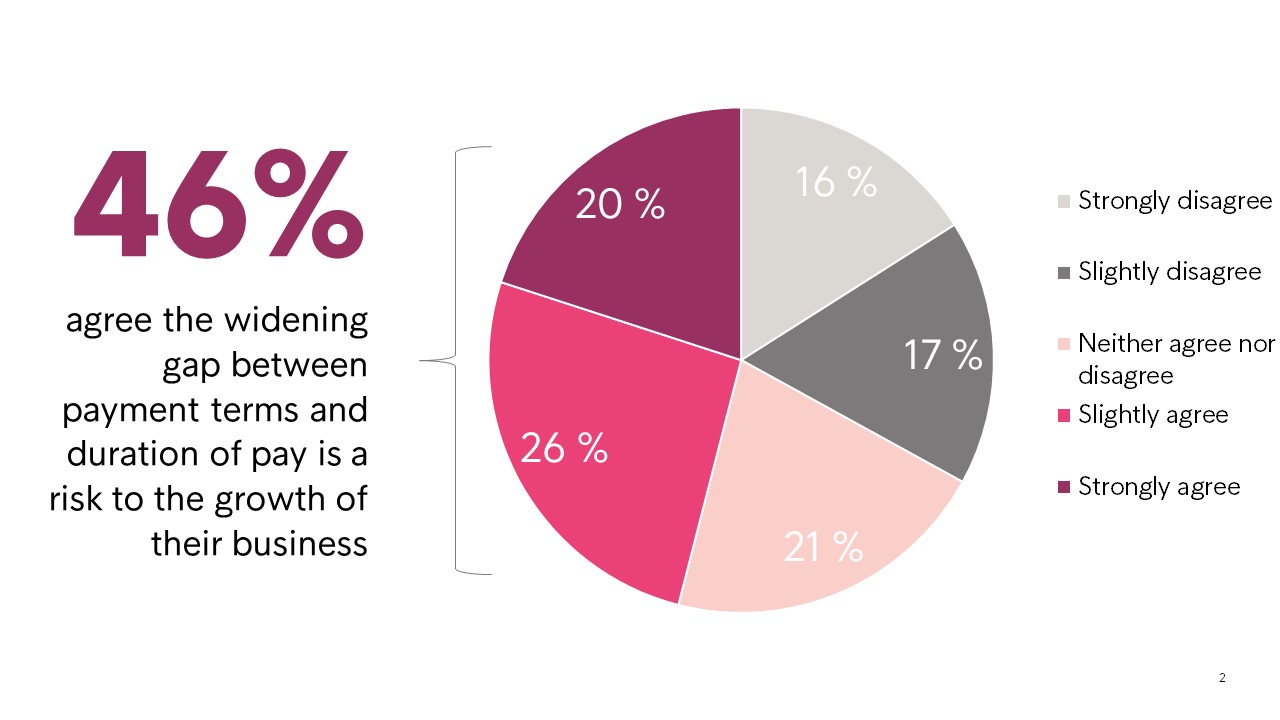

This serves to put businesses under pressure by reducing liquidity, leaving them to search for alternative ways to free up cash. Our survey respondents agree: nearly half (46 per cent) say the widening gap is a real risk to the sustainable growth of their business.

To what extent do you agree or disagree with the following statements? - The widening gap between payment terms and duration of pay is a real risk to the sustainable growth of our business

The payment gap is pushing businesses into difficult positions. “It’s very crucial that customers pay us on time,” notes Jan Karlsson Ovako AB. “If not, we would need to fund the business with more equity, or even further bank loans.”

Complex billing procedures and a lengthy payment chain mean that getting paid on time can be a challenge. Moreover, the issue is becoming even more urgent given the pressure that the pandemic is putting on the industry sectors across Europe.

It’s very crucial that customers pay us on time. If not, we would need to fund the business with more equity, or even further bank loans.Jan Karlsson, Group Purchasing & Credit control & Category purchasing Manager at Ovako AB

Yet few businesses are taking action against this growing problem. Despite their need for payment, many firms are reluctant to challenge unfair practices for fear of losing business or tarnishing their reputation. That applies to 69 percent of European businesses.

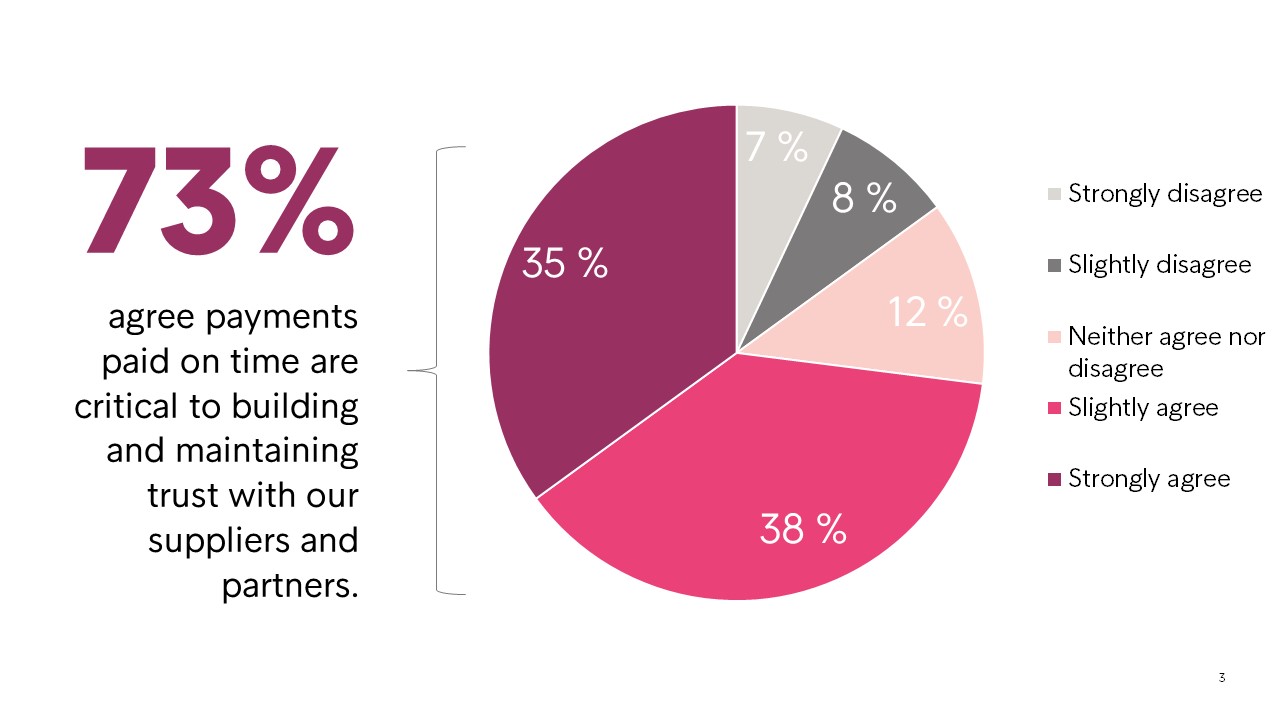

Timely payment ensures long-term sustainability of the business cycle

In the current environment, improving debt-recovery programmes will be key to building long-term customer relationships, according to the head of recovery at a major Southern European bank. When a customer has a problem with the payment, this should not be viewed as the end of the relationship,” he says. “It is the start. An effective recovery strategy will build loyal customer relationships in the long-term.”

We need to balance the need to secure our credit with maintaining customer loyalty. This is a difficult line to tread, but crucial to get right.Fabrizio Trinei, Italian Credit Manager at Avis Budget Group EMEA

Meanwhile, Fabrizio Trinei, Italian Credit Manager at Avis Budget Group EMEA, describes the importance of agility in the strategic response to Covid-19. “We need to think quickly, on our feet, and respond with the correct strategy,” he explains. “We need to balance the need to secure our credit with maintaining customer loyalty. This is a difficult line to tread, but crucial to get right.”

To what extent do you agree or disagree with the following statements? - Payments paid on time are critical to building and maintaining trust with our suppliers and partners

About the survey:

The report is based on a survey that was conducted simultaneously in 29 European countries between 14th February and 14th May 2020. A total of 9,980 companies across 11 industries in Europe participated in the research.