Consumers are struggling to save for their long-term financial security

The European Consumer Payment Report (ECPR) is an annual report which describes European consumers ability to manage household finances. The report is based on an external survey of 24,000 consumers in 24 European countries.

The newly launched report show that as financial challenges mount, consumers are struggling to save for their long-term financial security.

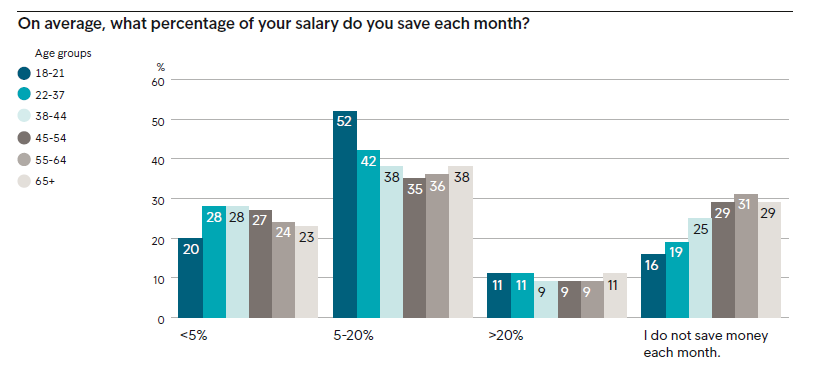

As living costs rise, our survey shows the majority (75 percent) of consumers are still managing to save part of their salary each month, but over half (52 percent) are dissatisfied with the amount they can save.

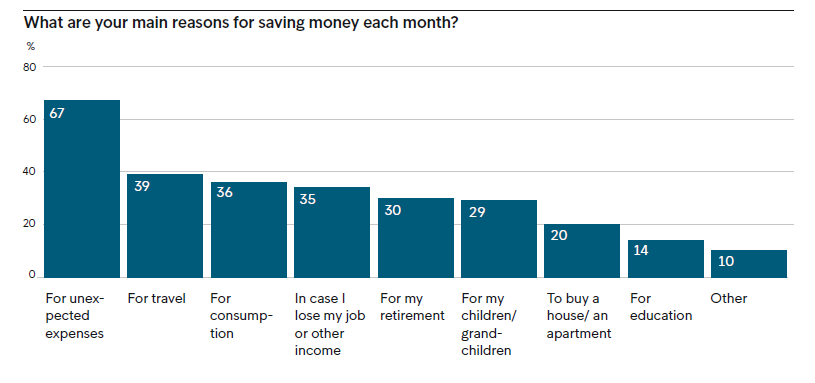

Closer examination of consumers’ motivations for saving reveal they are not taking a long-term view. The risk posed by unexpected expenses is the top reason for saving each month, followed by travel (39 percent) and consumption (36 percent).

Only 30 percent of respondents cite saving for retirement as a key motivation, while nearly two-fifths (36 percent) think they will struggle to afford a comfortable retirement based on their ability to save long-term.

When looking at age groups we see, perhaps not surprisingly, that young Europeans, 18-21-year-olds, are the most active savers. On the other side, 11 percent of seniors over the age of 65 years cite to save more than 20 percent of their income each month.

Interested in how saving culture among consumers in your country look like?

All results are published in the European Consumer Payment Report (ECPR) 2019.