Financial wellbeing continue to decline as a result of Covid-19

In the wake of the pandemic, consumers experience falling incomes and a further decline in their financial wellbeing.

Covid-19 has had a serious impact on consumer finances. Half of the 24,000 European respondents to our 2020 study (47 per cent) tell us they are more concerned about their financial wellbeing than ever before. At the same time, one in three (35 per cent) say they lost income as a direct result of the crisis.

Our research also suggests that the pandemic is hitting some harder than others. In particular, we see the most vulnerable in society – such as those with lower incomes, unreliable employment or challenging family responsibilities – affected the most.

Differences by region

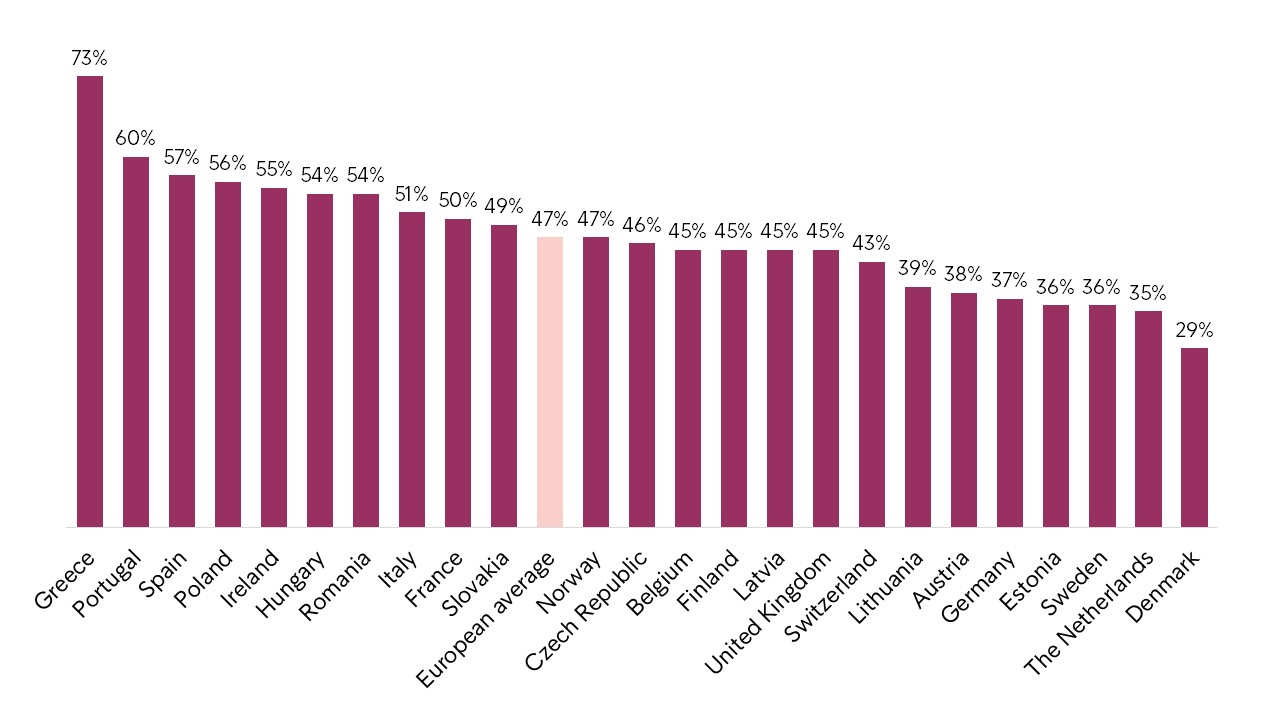

Consumer stress levels are on the rise, especially in Southern European countries where the virus has had a pronounced effect on the economy. In Greece, where falling tourism revenues undermined an economy that was still recovering from a 10-year financial crisis, 49 per cent of respondents lost earnings due to the pandemic and three in four (73 per cent) say they have never been so worried about their finances.

I am more concerned about my financial wellbeing than I have been at any other point in my life (agree):

Respondents in many Northern European countries, where consumers typically already have higher household disposable incomes per capita – and where governments may be better placed to provide a wider safety net – have been less badly affected by the pandemic.

A comparatively modest 29 per cent of Danish consumers express apprehension about their finances, and less than one in five (19 per cent) have lost income. We see a similar pattern in other Nordic countries.

A generational divide

Inevitably, the pandemic has shown that seniors are at greater risk of health-related complications from Covid-19, but it is younger consumers who are the most affected financially. As companies struggle to overcome decreasing demand and maintain liquidity, they are taking action to save costs.

We see that it is the younger generation, which has less work experience and fewer savings to fall back on, that is more likely to be furloughed or made redundant as a consequence. According to our survey, income levels become more resilient with age: 50 per cent of Gen Z (ages 18-21) say their incomes have decreased following Covid-19, versus just 15 per cent among seniors (age 65+).

The pandemic deepens inequalities

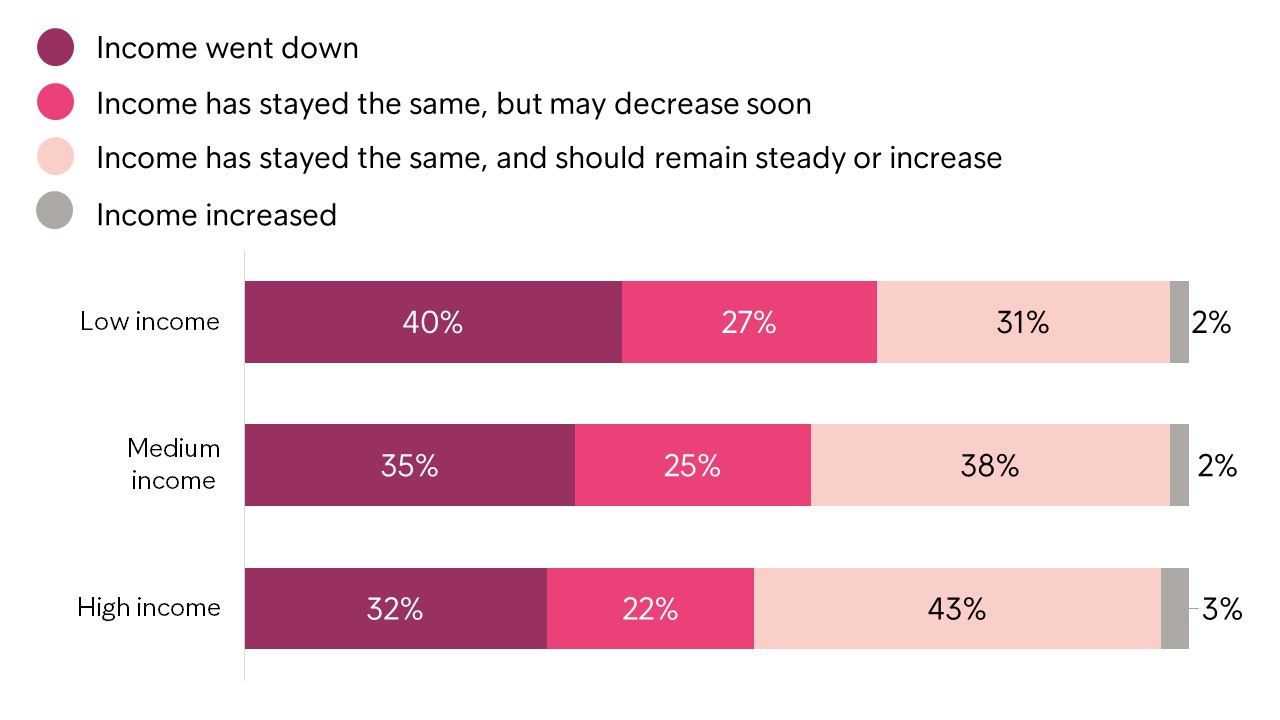

Our survey suggests that the crisis is having a disproportionate impact on those consumers who already have less secure finances. We see 40 per cent of respondents with lower annual incomes report a loss in earnings as a result of the crisis, compared with 35 per cent of those on medium incomes and 32 per cent on higher incomes.

To what extent, if at all, has your income been affected by the Covid-19 crisis? (split by income brackets)

Of those consumers who lost earnings as a result of the crisis, most (57 per cent) have reacted by cutting their everyday spending as a result, whereas others are seeking additional or part-time work or are borrowing from friends and family.

Despite many organisations offering payment holidays – which allow consumers to postpone occasional debt or other payments – only 9 per cent of respondents who lost income took advantage of these. Of those that did use payment holidays, it was most frequently to cover credit card, overdraft and personal loan payments, followed by mortgage or rent payments.

A wake-up call that raises concerns about the longer term

The economic fallout from Covid-19 is weighing heavily on Europeans’ minds. Nearly half (47 per cent) say their finances are not secure enough to guarantee a stress-free life. This percentage rises to 66 per cent among Greek and 62 per cent among Polish consumers. For consumers in Poland, these concerns mirror a challenging outlook for the country’s economy, which is expected to contract for the first time in almost three decades.

Are you interested to learn more about how Covid-19 has impacted consumers in your country?