For many European couples, Valentine’s Day is overshadowed by money worries

The Covid-19 pandemic is not only affecting European consumers’ personal finances, it’s straining many personal relationships too. Could better financial education help bring the romance back?

In the wake of the Covid-19 pandemic, nearly half of the 24,000 respondents to Intrum’s 2020 European Consumer Payment Report (ECPR) told us they are more concerned about their financial well-being than ever before, while 35% reported lost income due to the ongoing economic fallout.

But, this Valentine’s Day, our research also finds that rising consumer stress levels over personal finance issues are affecting many people’s domestic relationships, too.

Key European findings

Overall, 22% of European consumers say they struggle to talk openly about finances with their partner, while for 17% of respondents money conversations are the main source of tension and arguments in their relationship.

Almost one in three (29%) say it would be better for their relationship if they and their partner were better at managing their bills and savings. One in five say their partner has a poor understanding of financial matters, making decisions that are bad for their household.

22% of European consumers say they struggle to talk openly about finances with their partner. And one in five say their partner has a poor understanding of financial matters, making decisions that are bad for their household.Insights from European Consumer Payment Report

But the most striking and unromantic finding of all is that as many as 15% of people say that their financial situation is a factor in them not ending an unhappy relationship.

Although the issue of gender-based pay disparity remains stubbornly resistant to long-overdue change, our report finds no significant differences in responses by gender to these questions.

But there is a clear divide by generation. Younger respondents (those between the ages of 18 and 44) are much more likely to agree with the issues outlined in each category; older respondents, especially pensioners, view them as less significant, partly due to their tendency to have more settled personal finances.

Differences by country

The north-south divide that’s been observed in previous ECPR reports still remains. While the effects of the pandemic are causing rising consumer stress levels all across Europe, the underlying weaknesses of Southern European economies means they rank higher in most of the categories here, with their Northern European counterparts tending to be at the lower end of the scale.

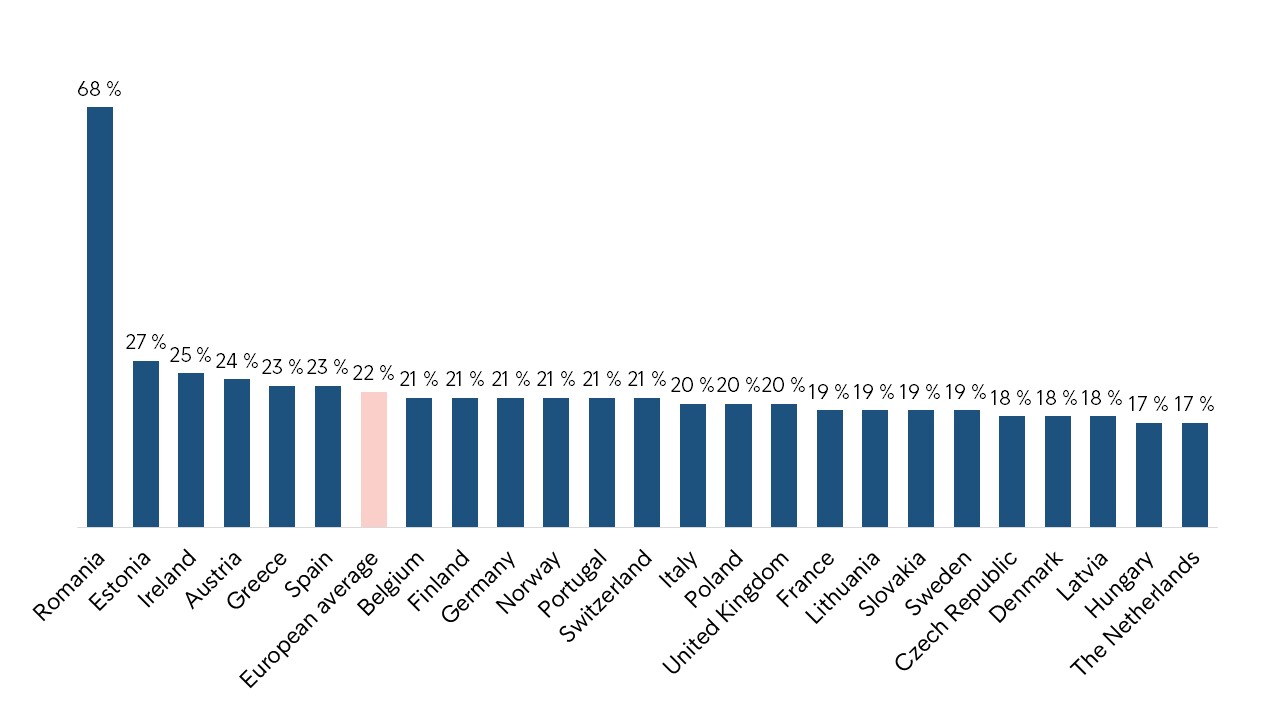

It’s Romanian couples’ relationships that seem to be particularly affected by financial issues: as many as 68% of Romanians struggle to talk about finances with their partner. Estonia is next on the list, but far below at 27%.

I struggle to talk openly about finances with my partner (agree, split by countries)

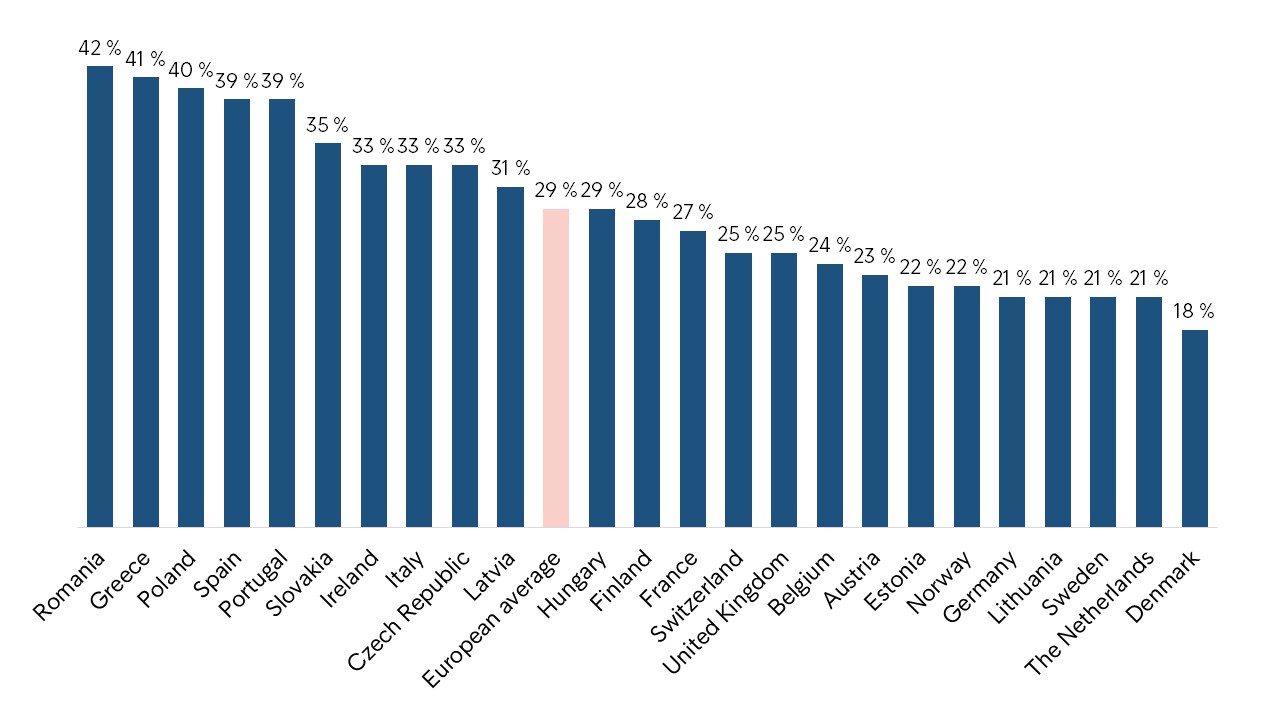

42% of Romanians think better household economy would improve their relationship. Greece (41%), Poland (40%) and Spain and Portugal (39%) all follow close behind. Sweden, Germany, The Netherlands and Lithuania (21%) and Denmark (18%) are at the other end of the scale.

It would be better for my relationship if my partner and I were better at managing our bills and savings (agree, split by countries)

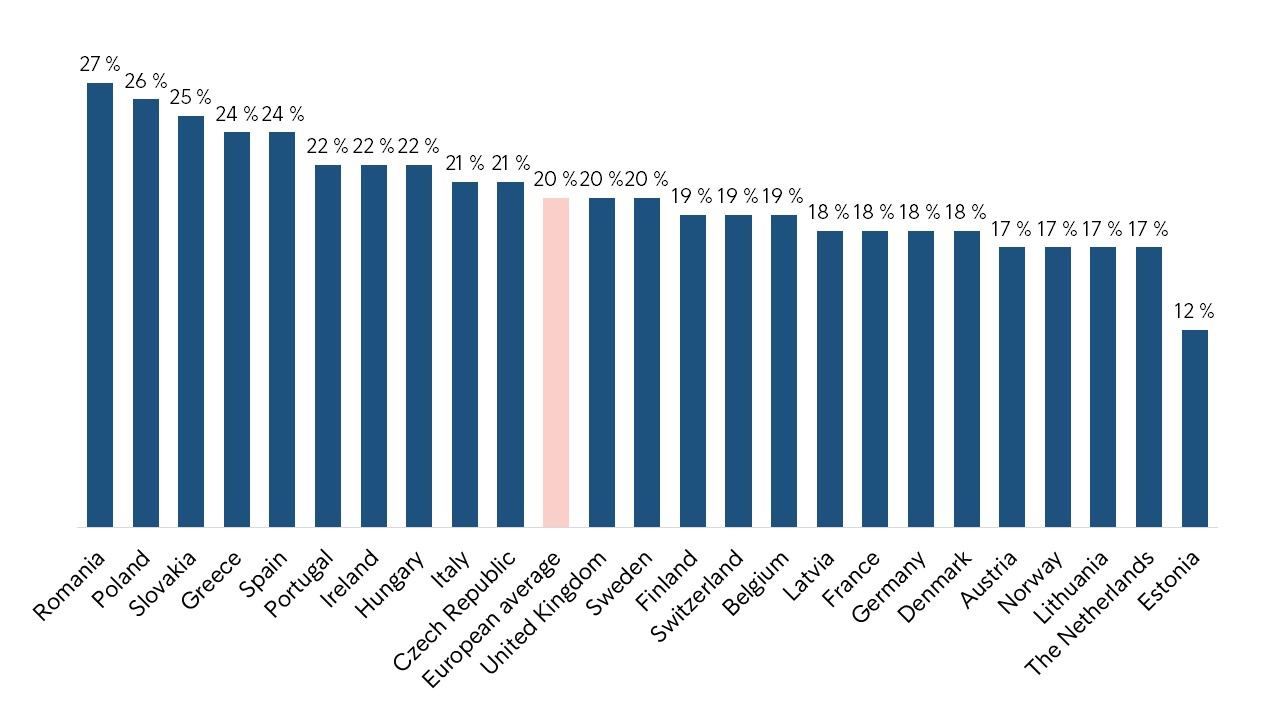

27% of Romanians, well above the European average of 20%, think their partner lacks understanding of finances; in Poland and Slovakia it’s 26 and 25%, respectively. German, Dutch, Norwegian and Danish consumers are much less critical, at 18 and 17%.

My partner has a poor understanding of financial matters and makes decisions that are bad for our household (agree, split by countries)

The importance of financial education

A common theme in Intrum’s consumer payment reports is the importance of financial education. Better education about personal finances brings more informed and beneficial financial decisions. It also gives consumers a level of control and organisation of their own personal finances that will help them individually but also collectively, in terms of both the joint household finances and their relationship dynamic.

Financial dependency is a very real issue in many relationships.As Stockholm-based psychologist and author Björn Hedensjö

Better financial education also helps to address issues of financial dependence, where one of the couple can be impacted by the flaws in one person’s decision-making. As Stockholm-based psychologist and author Björn Hedensjö says, “Financial dependency is a very real issue in many relationships.”

In addition to this, improved financial literacy helps ensure that couples can make an effective financial plan to which they are both committed. At a time when the pandemic is reducing income, threatening jobs and signalling economic uncertainty, the need for consumers to have the knowledge to manage their finances is more acute than ever.

Given the correlation between financial problems and relationship difficulties that feature in our ECPR findings, improving financial education could for many European couples be the ideal Valentine’s Day present that brings the romance back.

About the report:

The European Consumer Payment Report is based on an external survey of 24,198 consumers in 24 European countries. The field work took place between 28th of August and 5th of October 2020.