More Nordic seniors is struggling with debt

More senior citizens are struggling with debt in the Nordic region and the growth is twice as large compared to other age groups. “Underlying long-term demographic trends and new consumption patterns can be two explaining factors,” says Anette Willumsen, Managing Director – North European Region.

When you picture the average debtor, you could be forgiven for immediately thinking of a someone in their 20s, giving in to peer pressure, influencers, SMS loans and the temptations of online shopping.

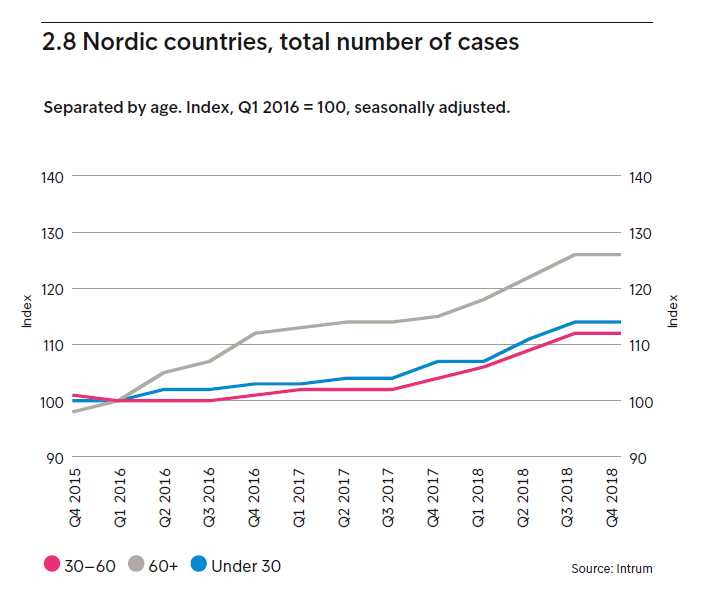

But these days, credit behaviour is becoming harder to predict. The 2019 Nordic Debt Collection Analysis carried out by European credit management agency Intrum finds that the number of debt collection cases among seniors over 60 years old have increased by 25 per cent over the last two years. In comparison, the increase has been only 14 and 12 per cent for people age under 30 and 30 to 60 years old, respectively.

The growth in cases among seniors is about twice as large compared to other age groups, and, although it is starting from what was a low base, it does signal that credit behaviour among the older generations is becoming more and more like that of younger age groups.

So why has debt become more of an issue for a sector of the population that was historically seen as having stable finances?

The senior generation is now accustomed to debt

One explanation is the passage of time, meaning that the new generation of senior citizens are accustomed to not just healthy credit, but the idea of living with debt, simply because this phenomenon has nowadays become more acceptable in society. Recent studies by the global analytics company Nielsen and by Intrum have found that debt is “a fact of life” for consumers of all ages, from 15 to 65 and over.

Underlying long-term demographic trends and new consumption patterns can be two explaining factorsAnette Willumsen, Managing Director – North European Region

A lot of life-changing events happen after the age of 60: retirement and a shift to fixed

incomes and savings; health issues; a spouse passing away; or people simply beginning to fulfil lifelong dreams, now that there is more available time. All of these impact their credit habits and payment ability.

Norway’s outreach to older debtors

In the Nordic context, we can look to Norway as leading the way in helping to tackle the issue of debt among the older generation. In 2016, the Norwegian Retirees Foundation (Pensjonistforbundet) set up a financial helpline to meet the needs of its 230,000 members, but in 2018 it established a partnership with Lindorff for financial and professional to develop the service further.

“The finance helpline is like economic first aid,” says Carsten O. Five, the leader of the service. Questions about pensions and taxes, moving to a less expensive home, housing support and nursing home costs predominate.

He adds, “About half of the phone calls we get are from pensioners who have decent finances, but who need advice on how to bring in some more money for their everyday living. The other group generally has had poor advice on financial issues. These people often have no one else to talk to - not even family. For them it is of the utmost importance to have a neutral party to talk to.”

If you’re struggling with debt, speak to a professional advisor

Part of the battle in dealing with problems is taking the first step to pick up the phone and speak to an expert, something which we at Intrum encourages people to do.

The core of our business is helping people out of debt, and our recommendation is to get in touch with us as early as possible, so that we can solve the case togetherAnette Willumsen, Managing Director – North European Region

About the report: The Nordic Debt Collection analysis seeks to close the knowledge gap between debt collection and the general economic development. The analysis provides insight on which direction the default market is currently heading and to point out the key drivers behind the observed market movements. The analysis is based on our internal data.