SMEs slipping on payments as inflation bites

Historically, large companies have been the culprits when it comes to late payment, with a reputation for squeezing their smaller suppliers. However, the economic crisis is hitting small companies hard, to the extent that their own payment performance has deteriorated.

Traditionally, small and medium-sized businesses (SMEs) have been better payers than their larger peers. However, recent economic challenges are proving a stiff challenge, and many are now struggling to make payments on time. As a result, firms are increasingly interested in Late Payment Directive reform, seeing the legislation as a possible answer to the issue.

According to Intrum’s 2023 European Payment Report, the number of SMEs who have been asked to accept longer payment is growing. In 2023, 83% said they’ve been asked to accept longer payment terms than they feel comfortable with, up from 81% in 2022 and 78% in 2021. Half of all SME businesses (51%) have accepted the terms as they didn’t want to damage customer relationships.

SMEs forced to pay their own suppliers late

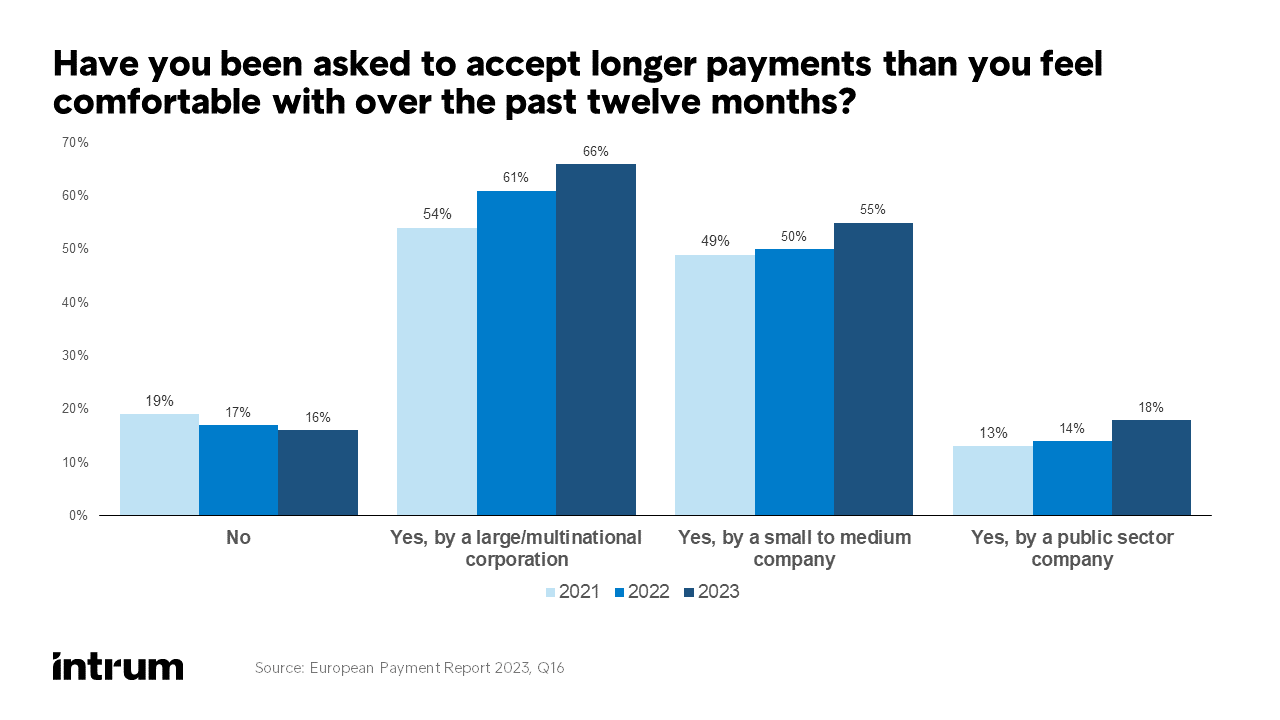

Meanwhile, the figures also show that SMEs are increasingly asking for payment leniency from their own suppliers. In 2023, more than half (55%) of businesses reported that they’d been asked to accept longer payment terms from SMEs – up from 49% in 2021.

This is still less than large organisations – two thirds (66%) of those surveyed said they’d experienced demand from big firms for longer payments than they felt comfortable with. However, the change demonstrates the increasing pressure SMEs are under.

Businesses themselves admit to the issue. More than a third of SMEs (38%) said they increasingly pay their suppliers later than they would ever accept from their own customers. This was higher than for larger companies (35%). Likewise, 53% of SMEs said they rarely think about the negative impact a late payment might have on a smaller business, whereas 52% of large businesses said they do consider this.

Antonella Correra is legal officer at the European Commission’s department for Internal Market, Industry, Entrepreneurship and SMEs. She says: “It’s something that is a very telling factor of the credit crunch – traditionally small companies have always been better payers. We have observed historically that the largest companies generally unfortunately have the worst payment behaviour."

The fact that now small companies are delaying payments is a factor of the difficult situations that they are in. It is time to ensure conditions that provide better predictability of payment. For a small company it’s important to know that they are going to be paid on the day that they negotiated and agreed.

Reform to the Late Payment Directive

The European Commission last year announced a review and planned reform of the Late Payment Directive – legislation that allows businesses to charge interest and compensation for late payment.

The Directive was put in place to protect businesses – particularly small firms – from late payment and to improve their competitiveness. The regulation applies to commercial transactions and specifies that public bodies should generally pay within 30 days and enterprises within 60, unless otherwise agreed. It automatically entitles businesses to interest for late payment and a minimum €40 compensation for recovery costs. Interest is set at 8% above the ECB rate.

Currently, only 17% of SMEs use the legislation all the time and half of SMEs don’t use it at all. However, 53% said a review of the existing regulations would make them exercise the rights provided, with improved enforcement (38%), mediation (38%) and greater clarity (30%) also desired.

Late payment is a vicious cycle and this is undoubtedly affecting SME payment performance.Benjamin Asplund, Global Commercial CMS Director at Intrum

“Hopefully, upcoming changes to the Late Payment Directive will reinvigorate its use, particularly for SMEs, which can be especially vulnerable to cash flow problems. In the meantime, many have been making efficiencies and taking steps to improve their credit management and collections performance. This will be of huge benefit as we come out of the downturn and thoughts move to growth,” adds Benjamin Asplund.