Which European country has the highest level of Financial Wellbeing?

A new element in the European Consumer Payment Report 2019 is the launch of the Financial Wellbeing Barometer. The Barometer provides additional means to track and compare consumers financial security to meet everyday spending needs and control of their finances across 24 European markets.

We define ‘financial wellbeing’ as having the financial security to meet everyday spending needs and be in control of your finances.

The Barometer measures financial wellbeing using four key pillars:

- Ability to pay bills on time

- Credit freedom

- Saving for the future

- Financial literacy

Under each pillar, we use key indicators – derived from our survey and, in some cases, from third-party sources – to measure the financial wellbeing of each country, generating a score of 1–10.

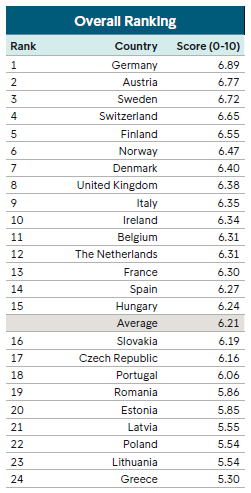

The Barometer presents an overall financial wellbeing score for each country – an aggregate score combining scores across all four pillars.

The barometer show that Germany, Austria and Sweden rank on top. Greece, Lithuania and Poland at bottom.

Key takeaways for the 2019 are:

Ability to pay bills on time

- German consumers’ confidence in paying bills on time.

- Healthy disposable incomes in the Nordics.

- Challenging financial picture in Greece.

Credit freedom

- Borrowing habits in countries with high debt-to-income ratio.

- Rising borrowing culture in Central and Eastern Europe.

Saving for the future

- Long-term saving for highest-ranking countries (Sweden, Switzerland and Germany).

- Stronger levels of financial education in highest-ranking countries.

- Lowest ranking countries display different saving habits (Greece, Romania and Latvia).

Financial literacy

- Correlation between financial literacy and saving for the future (Finland occupying 1st position).

- Broad range of educational sources among countries who rank high (UK and Irish consumers are more likely to seek advice from independent financial).

Interested to learn more about how it looks like for your country?

All results are published in the European Consumer Payment Report (ECPR) 2019.