Intrum insight on financial literacy aids European Commission

Intrum experts last month met with members of the European Commission to present the latest findings from the annual European Consumer Payment Report. The meeting focused on the organisations’ joint interest in understanding Europeans’ financial lives and wellbeing.

Raising financial competency across the European Union is an area of keen interest for the European Commission’s Directorate General for Financial Services and Capital Markets (FISMA), the department responsible for EU policy on banking and finance.

Following the publication of the latest European Consumer Payment Report in November 2021, Intrum presented its findings to members of FISMA’s Retail Payments and Capital Markets Union Units.

We conveyed to the Commission our finding that consumers need more help in securing stable finances, including stronger financial literacy skills. The participants from FISMA were particularly interested in hearing that many consumers appear to not understand their own financial education gap.Anna Fall, Chief Brand & Communication Officer at Intrum.

The newly-launched financial competence framework

The meeting came shortly before the Commission launched its financial competence framework for adults on 11 January. The framework aims to improve individuals’ financial skills and ability to make sound decisions about their personal finances.

Set up in collaboration with member states’ finance ministries, the framework defines 600 competencies in three categories: Digital, Sustainable and Resilience. It also includes a subsection on over-indebtedness.

The responsibility for implementing the framework now lies with the member states and relevant stakeholders. The Commission will work to establish a similar competency framework for children.

Shared interest in supporting financial well-being

“As well as demonstrating consumers’ growing desire to embrace sustainable and ethical businesses, Intrum’s European Consumer Payment Report research showed increased fears over inflation. We conveyed to the Commission our finding that consumers need more help in securing stable finances, including stronger financial literacy skills,” says Anna Fall, Chief Brand & Communication Officer at Intrum.

“The participants from FISMA were particularly interested in hearing that many consumers appear to not understand their own financial education gap.”

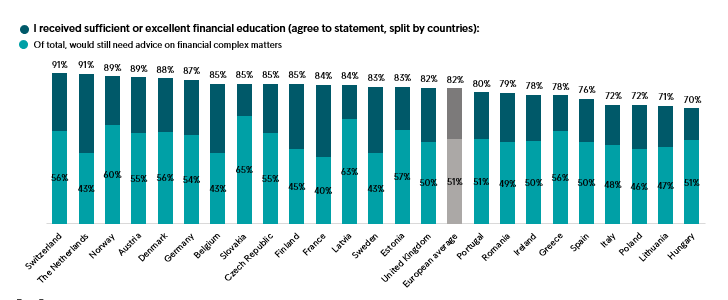

According to the report, eight in ten (82 per cent) respondents say that they have sufficient financial education, but 51 per cent admit to needing advice on complex financial matters such as stock market investments.

Additionally, a high number – 40 per cent – of respondents were unable to match terms like ‘budget’ or ‘inflation’ with the right definition and 34 per cent of consumers across Europe answered wrongly when asked to calculate a simple interest question.

This shows a gap in the perceived financial education consumers say they have achieved and their actual knowledge of basic financial terms and calculations.

Valuable data for ongoing change

Feedback from the Commission is that Intrum’s data has been valuable in its work (together with the OECD International Network on Financial Education) on the financial competence framework.

Following the outbreak of the financial crisis, the EU has put forward a series of reforms to secure financial stability and improve the supervision of financial markets. FISMA’s mission is to monitor the effectiveness of these reforms, ensure that EU legislation is fully implemented and respond to emerging financial risks.

These aims coincide with Intrum’s goal of leading the way to a sound economy. Ensuring businesses get paid and that their customers are treated with empathy is at the heart of this endeavour.