Consumers need education to secure financial wellbeing

On January 24, UNESCO’s International Day of Education 2022 aims to put a new social contract in education in motion – one that generates debate around transformations needed to build more equitable and inclusive education systems. At Intrum, we often see the results of poor financial education and the devastating effect it can have on wellbeing.

Good financial education is at the heart of a functioning society. After the disruption of Covid-19, there are signs that consumers are taking steps to improve their financial literacy and resilience but many are still in need of better financial education.

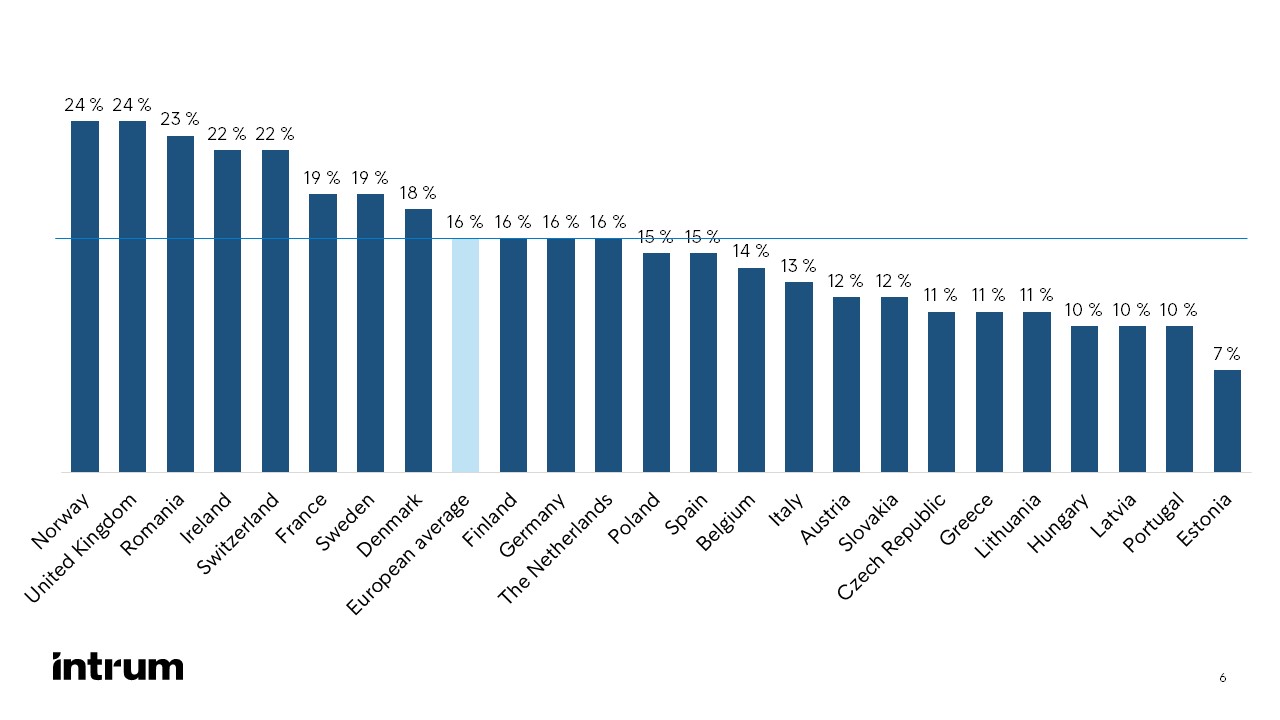

Intrum’s European Consumer Payment Report 2021 found that, on average, one in six Europeans (16 per cent) do not have control of their own debt, and in Norway and the UK almost a quarter (24 per cent) don’t know how much they owe.

I don’t want to know how much money I owe in total (agree to statement):

Worryingly, it is more like to be the younger generations who have lost track of the size of their debts. Many young consumers have little control of their personal finances, and may find themselves in a difficult financial situation at an early stage of life.

The pandemic has motivated consumers to improve their financial literacy

However, the pandemic does seem to have acted as a trigger for people to improve their financial literacy. Six in 10 (59 per cent) say they expect another global pandemic within their lifetimes, and so want to ensure they are in a stronger financial position before the next one hits.

As a result, consumers are striving to improve their financial wellbeing. Consumers are seeking to educate themselves and build stability for their families. Four in 10 are setting targets to better manage bills, and are putting aside ‘buffer’ money in case of a recession.

Younger consumers are more likely than their older peers to see the crisis as an opportune moment to improve their finances and build a more stable future for themselves and their families. Four in 10 (40 per cent) Gen Z consumers and 37 per cent of Millennials feel this way, compared with 27 per cent overall. The sentiment is also more common among those who had to rely on government support during the pandemic (49 per cent).

Getting to grips with financial nuances

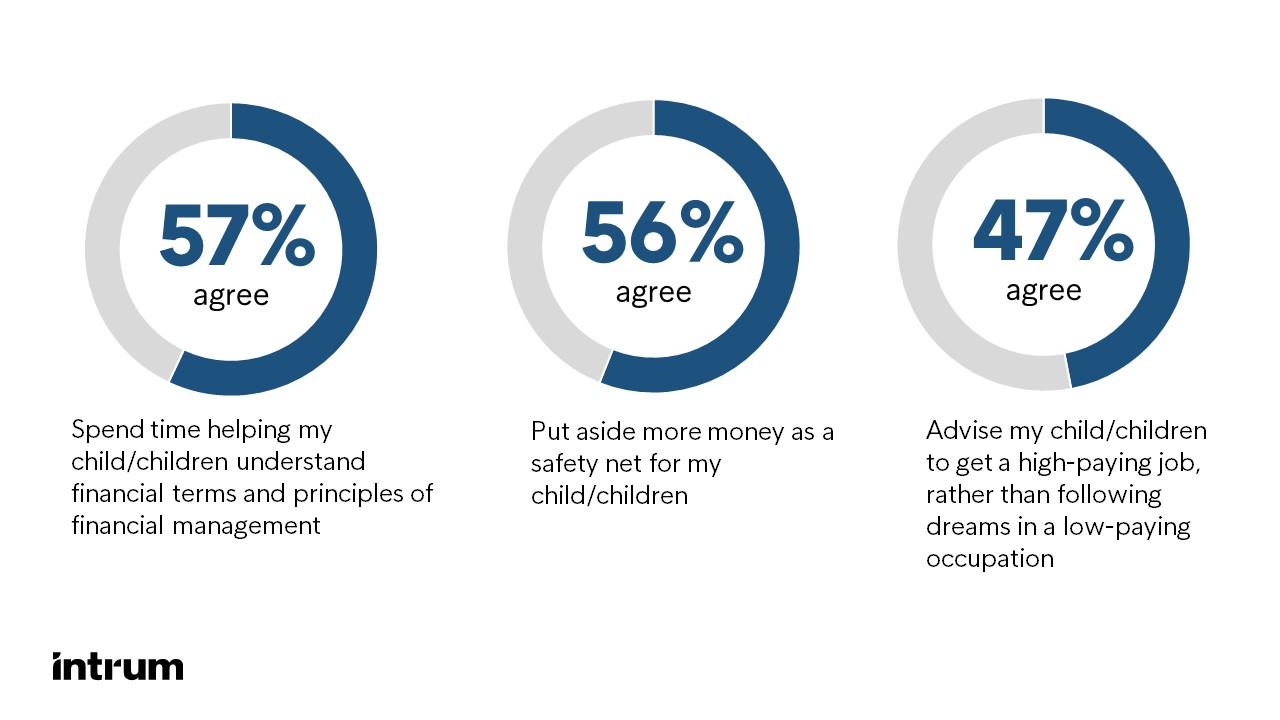

Attitudes to money are often set by parents. According to our survey, parents recognise the importance of starting financial education from an early age and are attempting to instil positive behaviours in the next generation. For instance, 57 per cent of those with children under 18 say they are spending more time helping their children understand the principles of financial management than they were before the crisis.

As a parent, with a child or children under 18, would you say you are more likely to do the following than you were before the pandemic?

Though this is great news advice can only be as good as the parent’s own financial education. While well-meaning, some parents may be missing the nuances within financial management. For example, six in ten told us they are more likely to urge their children not to take on any debt after the pandemic. In fact, managed correctly, debt supports entrepreneurship, home ownership and forms an integral part of the economy.

Debt concern inequality

For many people, debt concerns will continue to grow in 2022. A notable proportion of consumers are borrowing money or hitting their credit card limit when paying bills: more than a quarter (26 per cent) have done this over the past six months, rising to around 40 per cent of consumers under the age of 37.

These consumers were more likely to come from low-income households, with one in four more likely to miss a debt payment than at any other point they can remember.

These figures demonstrate the increasing pressure that has been placed on low-income households as a result of the pandemic. The effects of Covid-19 have exacerbated existing inequalities.

At Intrum, we believe strong financial education and support can make a big difference to financial and general wellbeing.