Savings challenge for struggling consumers

With the economic situation precarious, consumers and businesses alike are bracing for a difficult winter. World Savings Day is held on 31 October, against the backdrop of rising costs that mean putting money aside may be unrealistic.

In today’s economic environment, it’s more important than ever that people have money put aside for unexpected expenses. However, with the cost of living rising, energy bills rocketing, plus inflation and interest rates soaring across Europe, this may feel like an impossible challenge.

Intrum’s 2021 European Consumer Payment Report found that more than half of Europe’s consumers (54%) were dissatisfied with the amount of money they are able to put aside each month. The same number were worried that they won’t be able to afford a comfortable retirement.

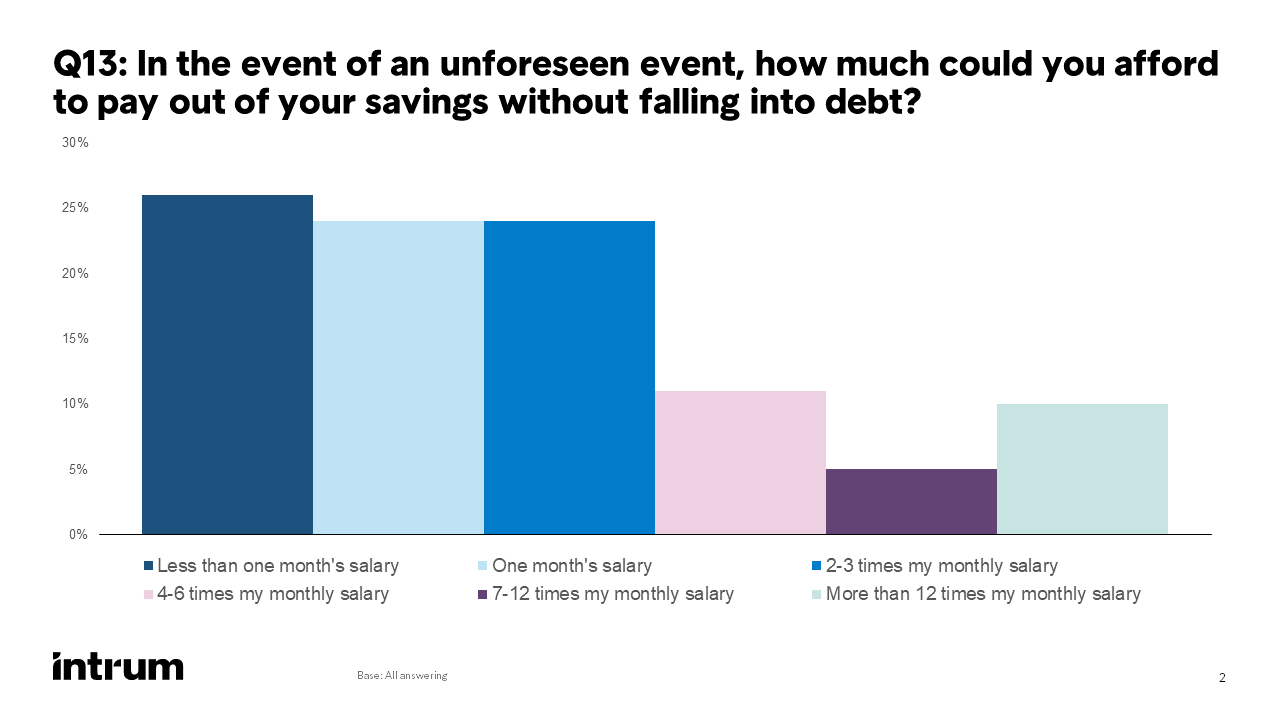

How much can consumers afford to pay for unexpected expenses without falling into debt?

With the latest version of the survey of over 24,000 consumers to be published next month, it is clear that the savings situation has worsened considerably in the past year.

Consumers are already feeling the squeeze and are worried about the future. We expect the new savings figures to be considerably worse than in 2022. This is causing many to feel stressed and vulnerable when it comes to their finances.Pia Bach Jensen, Global Front Office Director

At Intrum, we speak to more than 250,000 people across Europe about their finances every day, so we know first-hand how difficult things are for them. World Savings Day has in the past been known as World Thrift Day and we believe that in 2022 the focus should be on the small savings people can make to ease their financial situation.

“We know from our research that the Covid pandemic prompted many consumers to get their finances in better shape. The number one reason people tell us they save is for those unexpected expenses that can happen to all of us,” says Pia Bach Jensen. “From unexpected vet bills, to the washing machine breaking or more significant changes such as illness, bereavement and job loss, having money tucked away can smooth rough patches.”

While in better times it is easier to plan to put away large sums of money, this simply may not be feasible in this economic environment. Instead, we are encouraging people to make small changes that save them money and ease their day-to-day expenses.Pia Bach Jensen

Some of the things that can help:

While small savings and budgeting can make a big difference, there are many for whom this may not be enough. It’s important that those struggling reach out to their creditors and debt collection organisations for help when they need it.

A good collections organisation will always work with individuals to assess their financial situation and work out what, if any money they have left after essential bills. The aim is to create an affordable payment plan that means you can stop worrying about debt.

At Intrum, if circumstances change we work with our clients' customers to ensure they’re able to afford their repayments. When they get back on track and regain control of their finances, they can start to build up savings for a brighter future.Pia Bach Jensen