UN International SMEs day: Report finds SMEs still being pressured to accept longer payment periods

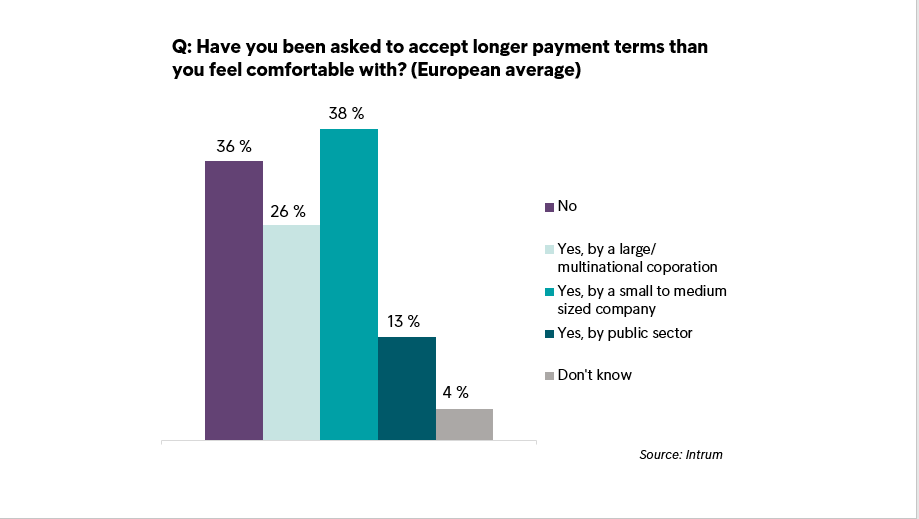

Six out of ten SMEs around Europe experience pressure to accept longer payment terms. One in four say the pressure is coming from large, multinational corporations. Sound payment terms should be the norm, says Mikael Ericson, CEO and President of Intrum.

On Thursday June 27, the United Nations marks the second international Micro, Small and Medium-Sized Enterprises Day, recognising the vital contribution that companies employing fewer than 250 people make to economies around the world.

The International Council for Small Business (ICSB) estimates that 90 per cent of all companies worldwide are small and medium enterprises (SMEs), accounting for between 60 and 70 per cent of global employment and 50 per cent of total GDP.

Despite the recognition, many SMEs are in no mood to celebrate

Worrying findings in the European Payment Report

The worrying findings come from the European Payment Report, an annual barometer of the European economy, with insights into the payment behavior and financial health of European businesses.

This year, in a survey of 11,856 companies in 29 countries, 64 per cent of SMEs answered that they have been asked to accept longer payment times than they feel comfortable with. Although larger companies are also facing longer payment times, 26 per cent of SMEs reported that they had been asked for these longer payment terms by a large corporation. And 23 per cent accepted those terms.

The report also found that businesses pay their bills after 40 days, up from the 34-day average in the 2018 report. These rising trends indicate that the bad payment habits of both businesses and the public sector are worsening, at a time when an economic downturn is looming.

This is an alarming signal which needs to be addressed. An important ingredient in a sound economy is safe and sound payments.Mikael Ericson, CEO and President of Intrum

Late payments affect SMEs’ viability

The impact of these late payments on SMEs is clear. 30 per cent of SMEs state that late payments have a high impact on their business in terms of liquidity squeeze and 27 per cent state the same regarding lost income. This has significant repercussions, threatening these businesses’ cash flow or their very existence.

And one-fifth (21 per cent) of the respondents to the report survey questions say faster payments would enable them to hire more employees.

Lack of payment precautions

Many SMEs don’t take precautions to protect themselves against bad payment behavior compared to large corporations. The report found that more SMEs are insecure about late payments.

This connects to the worrying lack of knowledge about the European Late Payment Directive, which has been in force since 2011. Only 27 per cent of SMEs are aware of the directive’s existence, compared with 57 per cent of large corporations.

How do we address the payments problem?

More than four out of ten respondents to the European Payment Report say new national legislation and voluntary initiatives would diminish the late payments problem.

In recent years, Intrum has been a prominent advocate in Sweden and beyond for payment times to be set at 30 days. The 30-day voluntary payment code that was launched by the Swedish Government and some of the country’s business leaders in 2018 was an initiative that was strongly supported by Intrum.

The company is also in regular contact with the European Commission in Brussels, presenting its findings to European politicians and administrators as they look at further ways to tackle the issue of late payments.

Sound payment terms and on-time payments require long-term changes in payment behaviour among European businesses. We at Intrum acknowledge the importance of paying on time and we support numerous initiatives regarding defined payment times.Mikael Ericson, CEO and President of Intrum