Black Friday – temptation comes knocking

With Black Friday now extended from one day of discounting to weeks of tempting retail offers and advertising build-up, are you struggling to resist the lure of a bargain? If so, you aren’t alone.

It’s extremely difficult to ignore the discounts and slick marketing hurled our way at this time of year. The temptation to overspend is intense. However, there are many reasons to think carefully before spending – from maintaining a healthy wallet to doing our bit for the environment.

Here are a few thoughts to make you pause before your finances take a Black Friday battering…

Do you really need it?

Still shopping?

Still tempted to take advantage of the offers? Perhaps you’ve saved some money for the sales and are keen to make it stretch as far as possible. Here are our tips for spending wisely…

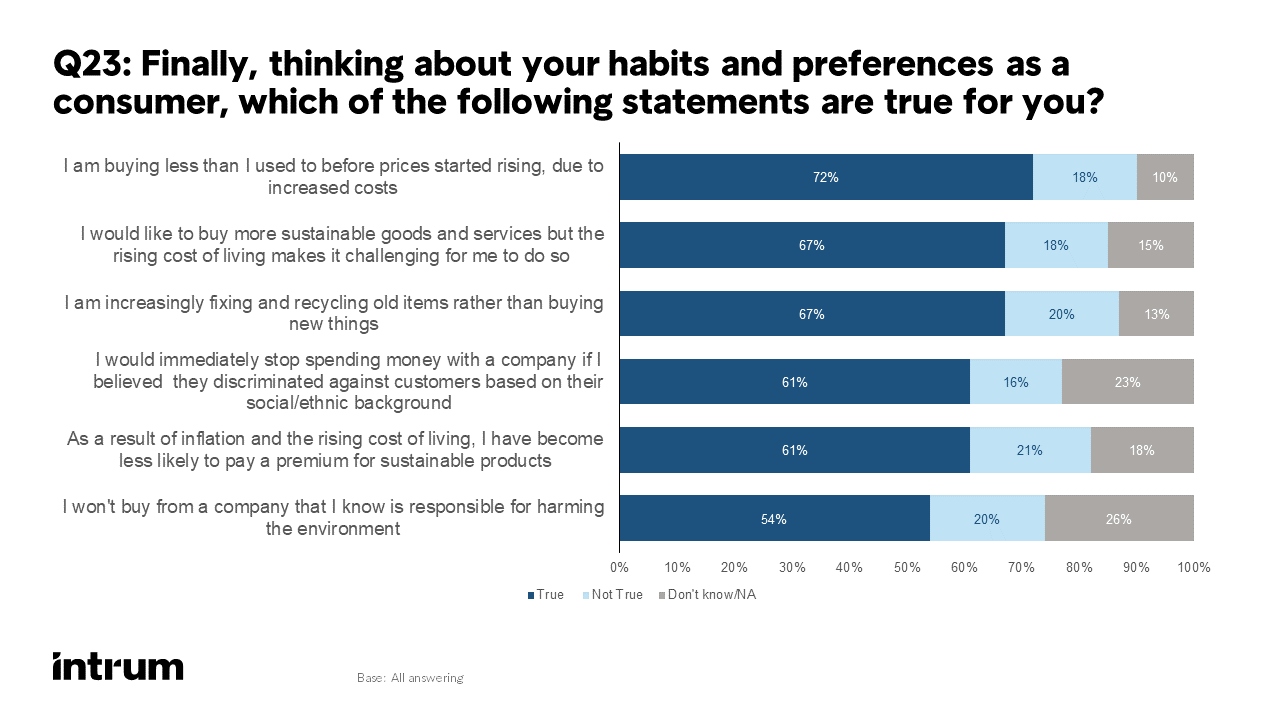

Ultimately, sustainability and the cost of living are two excellent reasons to cut back on sale shopping. Almost three quarters (72 per cent) of the people we surveyed said they are buying less than they used to before prices started rising, so if you’re cutting back you aren’t alone. Online and e-commerce bills are those we are most likely to default on when times get tough.

If you’ve already run into trouble, don’t ignore the problem. Talk to your creditors to find a solution. At Intrum, we’re always here to help.

Get more insights

This article is based on the insights from Intrum's European Consumer Payment Report 2022. You can download the full report today.