Changing the way we pay – adapting to consumer trends

The economic situation has forced consumers to confront their spending. While curbing a take away coffee habit isn’t enough to offset the rise in prices, are we changing our behaviour for the long term?

In September, the UK and Ireland boss of Supermarket Aldi said the cost of living crisis has transformed the way customers shop for groceries. Giles Hurley claimed that rising living costs have created a shift in attitudes, saying “a new generation of savvy shoppers have turned their back on traditional full price supermarkets”.

Findings from Intrum’s European Consumer Payment Report – an annual survey of 20,000 consumers across Europe – also show that consumers are questioning non-essential purchases such as digital subscriptions and take away coffees.

Two thirds (65%) said the rising cost of living has made them more aware of how much they spend on things they don’t need. A similar number (67%) are more inclined to buy the cheapest possible alternative of a product of service than they were 12 months ago.

To manage the impact of high interest rates and inflation, seven in 10 consumers said they would spend less on day-to-day expenses such as meals out and gifts in the next 12 months. In addition, 60% said they were likely to cancel or reduce their spending on a holiday or weekend trip.

The fact is that everything gets more and more expensive, the prices are rising all the time. And even though some products could get cheaper, they don't. So it's very hard for anyone to know how much their expenses are going to be next month.Statement from surveyed consumer

Sustainability and ‘greedflation’

As well as cutting back, consumers are choosing where to spend their money based on ethical concerns such as sustainability and ‘greedflation’.

Even under today’s financial pressure, consumers are far more aware of sustainability issues now than they were in the past. Our research has shown that they will vote with their feet and advise friends and family to avoid businesses who behave in unethical ways.

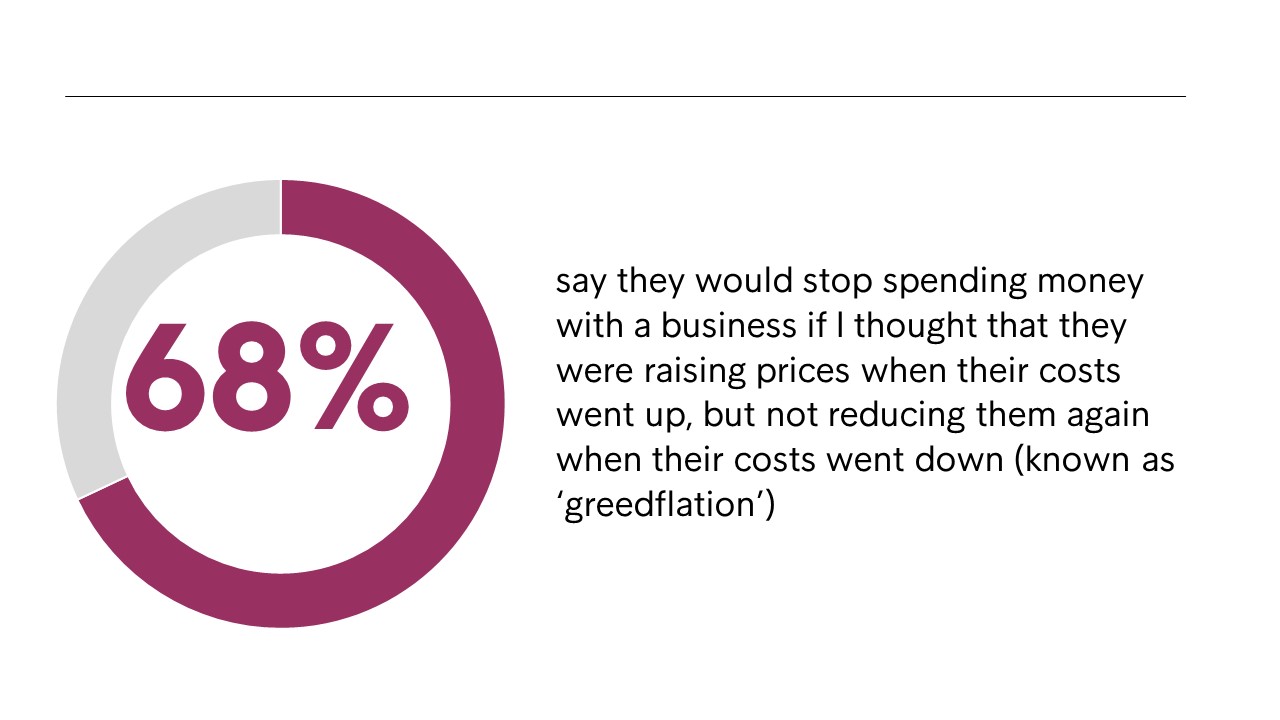

Almost seven in 10 (68%) say they would stop spending money with a business if they thought it was engaging in ‘greedflation’ – raising prices when costs went up but not reducing them again when costs went down.

Companies are increasingly aware of this challenge. In the annual European Payment Report published earlier this year, half (49%) of the 10,000 businesses questioned said they would rapidly lose customers if they were not seen to be taking their environmental responsibilities seriously. In the last year, six in 10 (58%) have significantly accelerated their efforts to become more sustainable.

Flexible payments a double-edged sword

When it comes to ethical practices, consumers also expect businesses to be flexible and understanding about payments.

Almost half (47%) of consumers told Intrum they are more likely to spend money with businesses that offer flexible payment terms – such as partial payments, multiple payment methods and flexible due dates. Two thirds (66%) said they felt businesses had a duty to offer flexible payment terms in an economic downturn.

However, 45% of those surveyed said they were surprised to see how much their monthly subscriptions can build up without them realising. A third (35%) say they find it difficult to keep track of buy-now, pay-later purchases and how much they can build up during the month.

This suggests that, while flexible payment options are important to customers, there is a danger that some ways of paying bills are less transparent and harder for them to manage.

For more information on consumer trends and payment behaviour, download the full European Consumer Payment Report, published November 2023.