Consumers find skipping bills more acceptable

Social norms around payments are changing as consumers struggle to pay their bills, according to the latest research by credit management group Intrum.

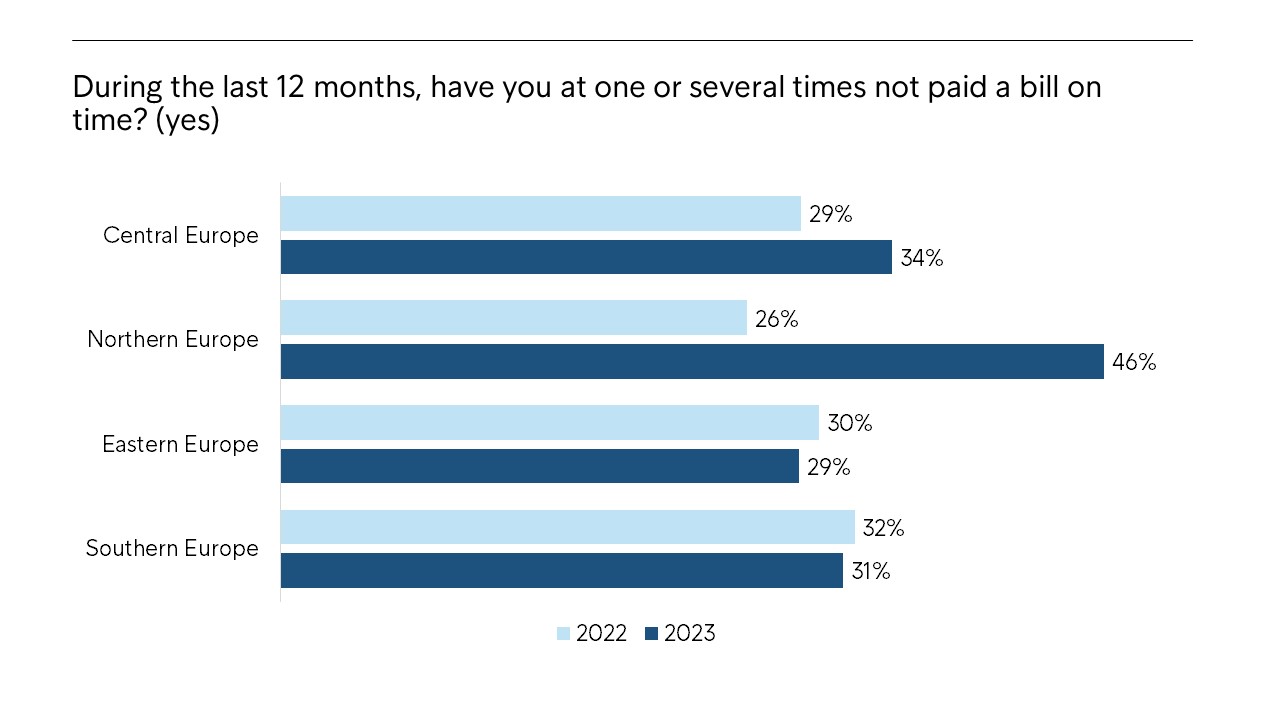

The cost-of-living crisis has stretched already-beleaguered consumers, with more than one in three of the 20,000 surveyed for the European Consumer Payment Report 2023 admitting to skipping a bill in the last 12 months. Around a quarter expect they will need to skip low priority bills in the next year as well.

While some failed to pay because forgot or had technical issues, 43% said it was down to lack of money. This is despite the fact that employment levels have remained high, so most people are still earning.

The economic difficulties have made some consumers feel helpless when it comes to managing their finances. Prices have risen far more quickly than real wages, cutting consumers’ purchasing power. With some consumers being forced to default, we see indications of changing attitudes towards non-payment. It is increasingly seen as something outside of many households’ control.

Just the cost of living increases. The mortgage has gone up, broadband has gone up, wifi, and so on. Electricity bills, cost of heating, and the cost of food. Unexpected costs like doctor's visits and repairing the car. It seems like any time you have an extra few quid, it just seems to disappear in increases in costs. It's very hard to get by.Statement from surveyed consumer

Geographies and generations

Northern European consumers are those most likely to say they’ve skipped a bill, with almost half (46 per cent) admitting to this, compared with less than a third in Eastern Europe.

This surge in missed payments may be attributed to a significant proportion of consumers in the Scandinavian regions having floating mortgage rates as opposed to fixed rates, a pattern distinct from many other European countries. Additionally, the northern countries exhibit a pronounced debt-to-income ratio, signifying substantial amounts of loans and mortgages. The prevalence of floating rates exposes these consumers to the rapid effects of monetary policies on their disposable income, offering insight into the factors contributing to this concerning trend.

The most challenged generations are the millennials and generation X, likely because those are the age groups most loaded with financial commitments a such as mortgages and household bills.

In fact, two thirds of those surveyed said they don’t believe they will ever be wealthy, no matter how hard they work and how much they save.

It’s not surprising that there’s a sense of pessimism among consumers. Six in ten have less spending money after essential bills and more than half don’t expect their circumstances to improve any time soon. They report little faith in policymakers’ ability to control inflation and are generally experiencing a sense of helplessness. This sense of despair may well impact businesses when it comes to payments.

Taking action on spending

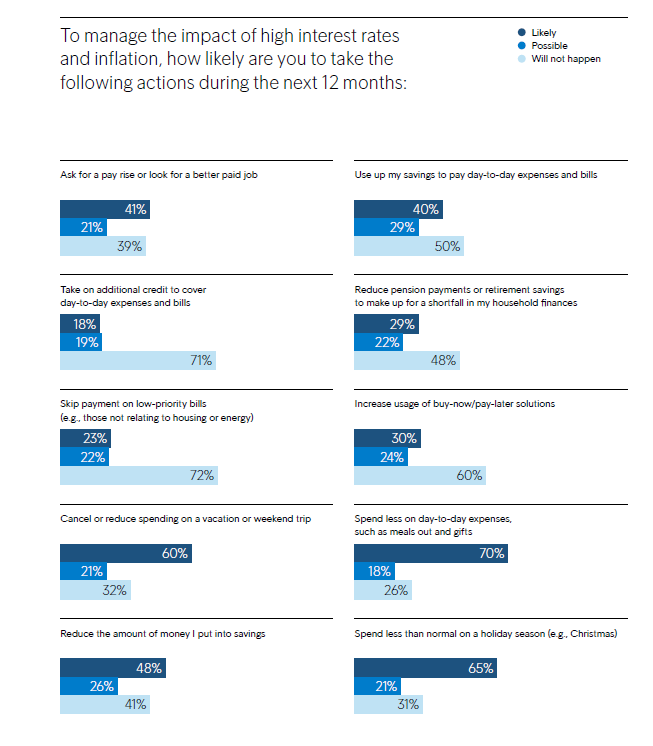

Consumers are cutting down on their day-to-day spending and their spending on holidays, meals out and gifts. More than half (54 per cent) are likely to increase their use of buy-now/pay-later options while 29 per cent are considering taking on additional credit to make ends meet.

Despite the fact that Intrum’s research shows European companies spend around a quarter of a trillion euros chasing late payments, almost a third of consumers don’t believe companies will bother to take action if they pay late.

With late payment responsible for a quarter of business bankruptcies, the knock-on effect of changing customer sentiment towards paying on time could be huge. We believe those businesses that take a sympathetic approach and work with their customers will benefit from that decision.

For more information on consumer trends and payment behaviour, download the full European Consumer Payment Report, published November 2023.