Failing to measure up in financial literacy

When it comes to improving consumer outcomes, raising levels of financial literacy could have a substantial effect on financial management and wellbeing.

Research suggests that financial literacy could have an even bigger impact on financial management and optimism than income level, and yet most consumers still don’t have the skills needed to navigate their finances.

Failing to understand finance

More than six in ten of the 20,000 consumers Intrum surveyed for the 2023 European Consumer Payment Report admitted they have insufficient understanding of basic financial concepts. When asked a question about inflation and how it would affect payments, 54% answered incorrectly or said they didn’t know, despite the fact that inflation has been a major issue for consumers this year.

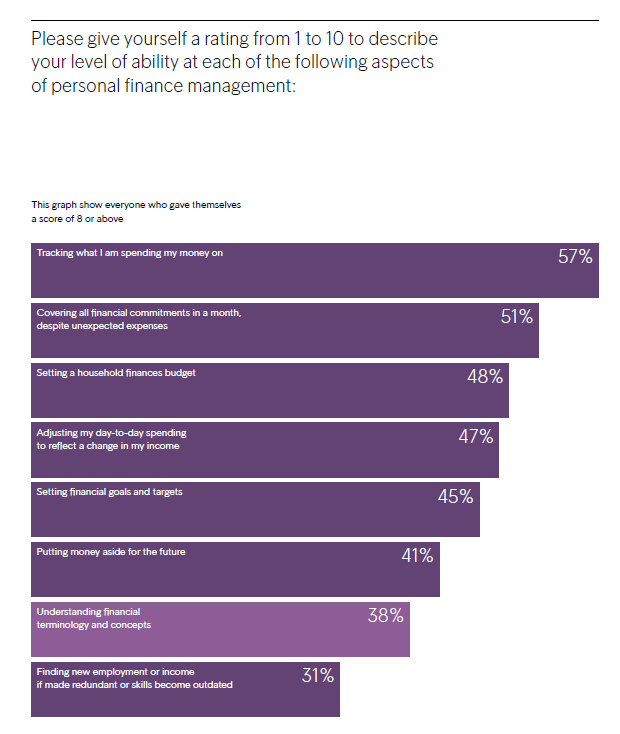

However, almost six in ten consumers did say they are good at tracking what they spend, suggesting the will is there to manage their money. Almost half said they are good at setting a household budget and a similar number said they can cover all their financial commitments in a month, even when unexpected expenses arise.

As well as having a material effect on their finances, financial literacy correlates with other positive outcomes for consumers. While many people do see the value of these skills, there is definitely room for improvement.

I find everything quite hard about budgeting and finances. I'm always late on payments and I can never keep up with my payment history. I am really struggling, to be honest. I don't know what else I could really do, to be honest. I really need some help.Statement from surveyed consumer

Financial skills correlate with better outcomes

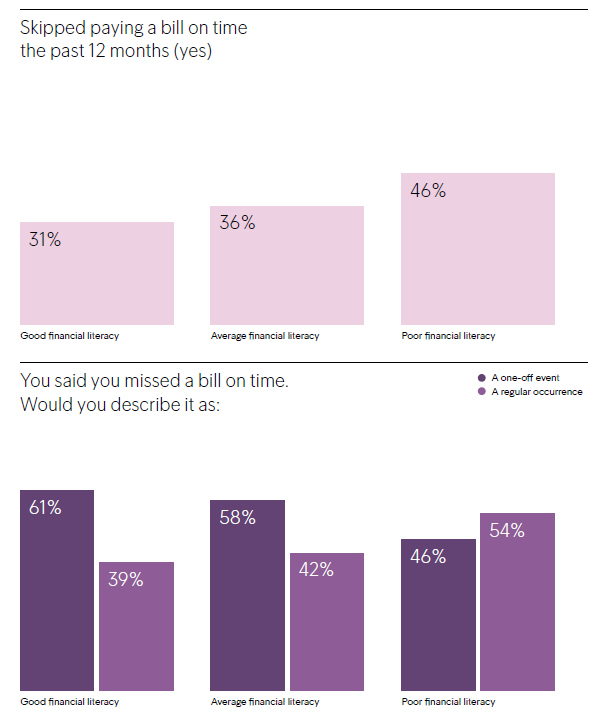

While 31% of consumers with good understanding of financial concepts failed to pay a bill over the last 12 months, the share rises to 46% for those with poor financial literacy.

Those with stronger financial literacy are also less likely to borrow money to pay bills, less likely to run out of money at the end of the month and are more likely to have some money put aside for emergencies.

Correlation does not guarantee causation. However, we see the financial literacy gap play out time and time again – even in the level of optimism that consumers have for the future. Those with poor financial literacy are more likely to believe that they will never become wealthy no matter how hard they work.

In times of difficulty, ensuring customers understand the product fully, realise the implications of non-payment and know the places they can go for help will make a big difference.