One in five of Europe’s SMEs say late payments are a threat to their business

Payment delays can stop European SMEs from growing, affect cash flow and lead to job losses

Nearly one in five (18%) of Europe’s small and medium-sized enterprises (SMEs) say that late payments threaten the survival of their business. After a period of economic growth, clouds are appearing on the horizon and SMEs across Europe report a somewhat pessimistic picture.

Late payments have long been an issue for SMEs (companies with less than 250 employees), and insights from Intrum’s European Payment Report 2019 reveal the scale of the challenge.

Late payments are a fact of life for every business, but they can have a serious effect on small and medium-sized enterprises (SMEs), harming their ability to pay employees and suppliers, cover operating costs, and pursue growth opportunities.

Barely surviving instead of thriving

SMEs in ten different European countries are on or above the European average of 18% for late payments threatening their business’ existence.

Particularly badly affected are companies in Poland (34%), Italy (33%) and Bosnia and Herzegovina (31%). It’s also a very significant issue in Germany (27%), Bulgaria (25%) and Slovenia (22%).

Other contributory findings:

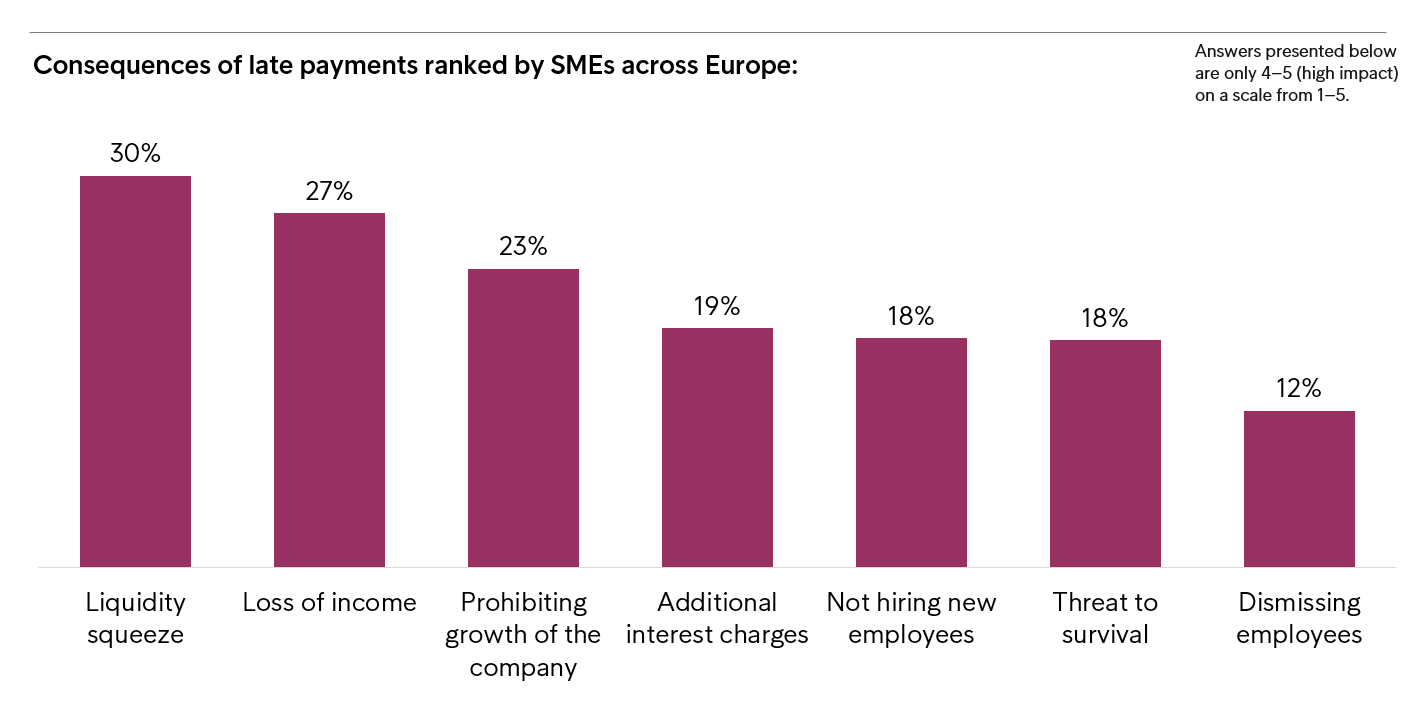

- 27% of European SMEs say that problems with late payments can lead to loss of income.

- And 30% of European SMEs report that late payments put a squeeze on liquidity (the figure is as high as 50% in Italy).

- 19% of European SMEs say late payments result in them facing additional interest payments.

At the other end of the scale, just 2% of Danish and 4% of Austrian businesses say late payments jeopardise their future.

Late payments cause job losses

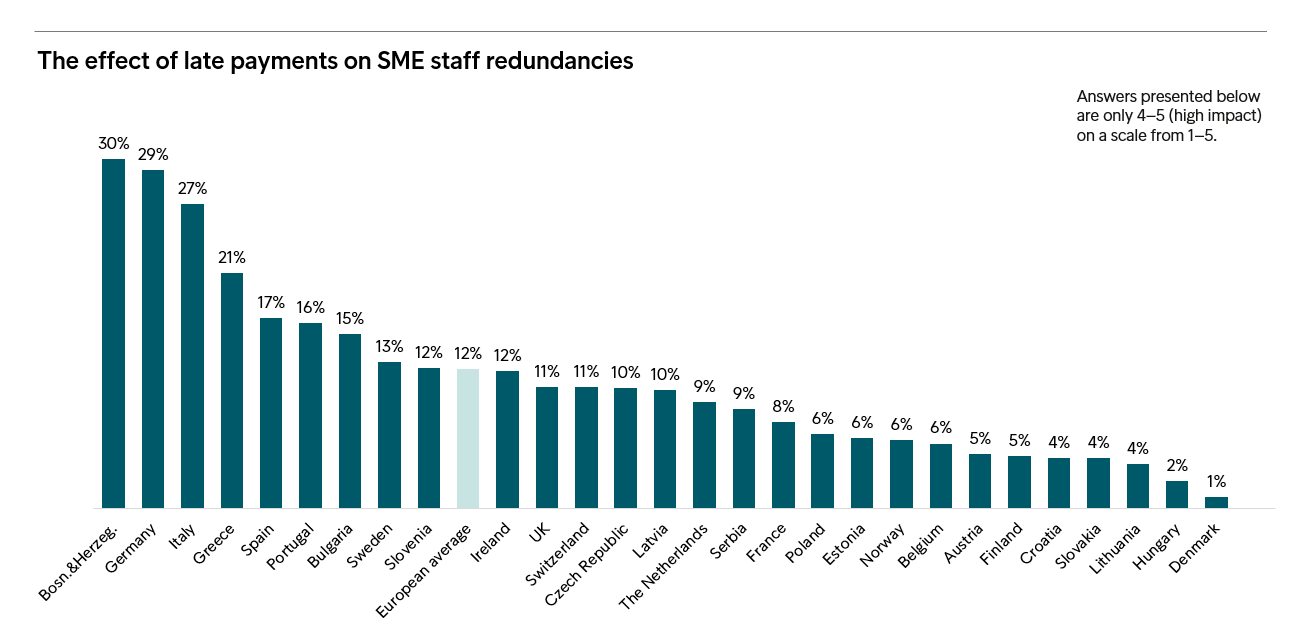

The human consequences of late payments are often lost in the focus on balance sheets, but Intrum’s report finds that late payments cause job losses.

- Three in ten (30%) Bosnian SMEs rate the consequence of late payments is a significant factor in them making employees redundant, followed by 29% of German companies.

- More than a quarter (27%) of Italian enterprises and 21% of Greek businesses also report having to lay off employees as a consequence of late payments.

- The results in Slovenia (17%), Poland (16%) and Bulgaria (15%) are also well above the European average of 12% and are worryingly high.

The survey from Intrum confirms once again how serious the situation of late payment is. It remains a challenge in all European countries, even in the ones which have a so-called “good payment” culture. We are concerned at this continuing trend among European businesses and we are working actively for sound payment terms at a European level.Luc Hendrickx, Director (Competitiveness of Enterprises - External Relations - Legal Affairs) at SMEunited

Affecting companies’ ability to hire new staff

Late payments also prevent companies from hiring more employees.

- 18% of European SMEs say that they couldn’t hire new staff due to late payments.

- The figure climbs to four in ten in Bosnia and Herzegovina and 38% in Italy.

- According to Statista, the two countries’ December 2019 unemployment rates stood at 21.2% (Bosnia) and 9.2% (Italy), making the late payments issue even more meaningful.

What if Italian and Bosnian companies were paid faster by their debtors? Exactly half of Italy’s SMEs say they would recruit more people and 49% of Bosnian SMEs say likewise. More than one in five European SMEs (21%) say they’d hire more staff if faster payments were made.

- Elsewhere, businesses in Greece (34%), Poland (33%) and Portugal (28%) all say that late payments stop them from bringing in new employees.

- 43% of Bulgarian and 37% of Greek companies say that they’d employ more people if their debtors paid up more quickly. Greece is grappling with a much more challenging financial picture than many other European countries. Greece’s average wage figure is one of the lowest in Europe, and unemployment is the highest.

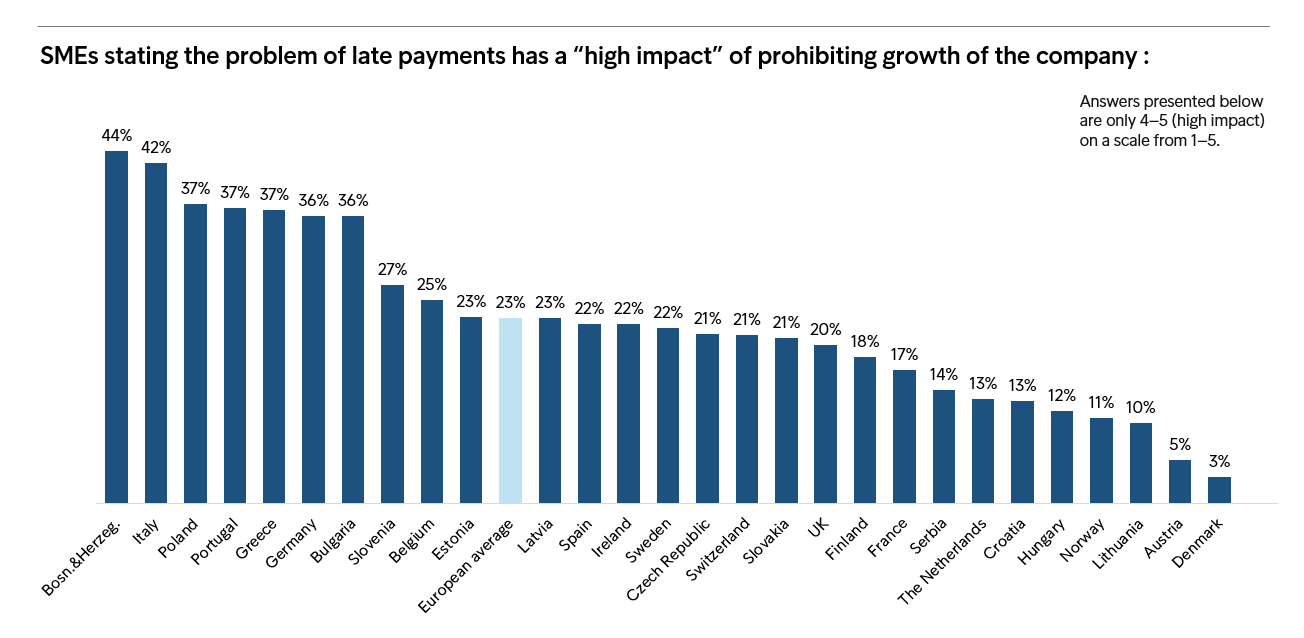

Late payments hit growth

Late payments also prevent SMEs from growing, in fact almost one in four (23%) of European companies. The issue is more pronounced when looking at Poland, Portugal and Greece (all 37%), and Germany (36%), while even at the lower end of the scale, 10% of Lithuanian companies report this as an issue.

Despite the problems, the European Payment Report 2019 also finds that 31% of European companies take no late payment precautions such as pre-payment, credit insurance or using debt collection services.

- 58% of Hungarian firms, 50% of Estonian companies and 47% of UK businesses take no such precautions.

- Austria (40%), Latvia (47%), Lithuania (43%) and Sweden (34%) prove this issue isn’t specific to a particular European region.

To find out more

All the results are published in Intrum’s European Payment Report (EPR) 2019. The report is based on a survey of 11,856 companies in 29 European countries.

About SMEunited:

SMEunited is a national cross-sectoral Craft and SME federations, European SME branch organisations and associate members. They speak on behalf of the 24 million SMEs in Europe which employ almost 95 million people and are a non-profit seeking and non-partisan organisation.