Counting the cost of love

As Valentine’s Day approaches, many will be feeling the pressure to spend money to show their partner that they care. But love doesn’t have to break the bank…

According to Intrum’s latest consumer research, more than a quarter (27 per cent) of us feel the rising cost of gifts and meals out is having a negative impact on our romantic life. This figure rises to almost half of those in Greece and Lithuania and a third of those in Ireland, Latvia, Romania and the UK.

The impact is also greater for younger people, with around four in ten 18-21 year olds and 22-37 year olds saying that cost is hitting them hard when it comes to romance. A quarter of consumers in these age groups say buying presents for their spouse or partner is the most common reason they go into credit card debt.

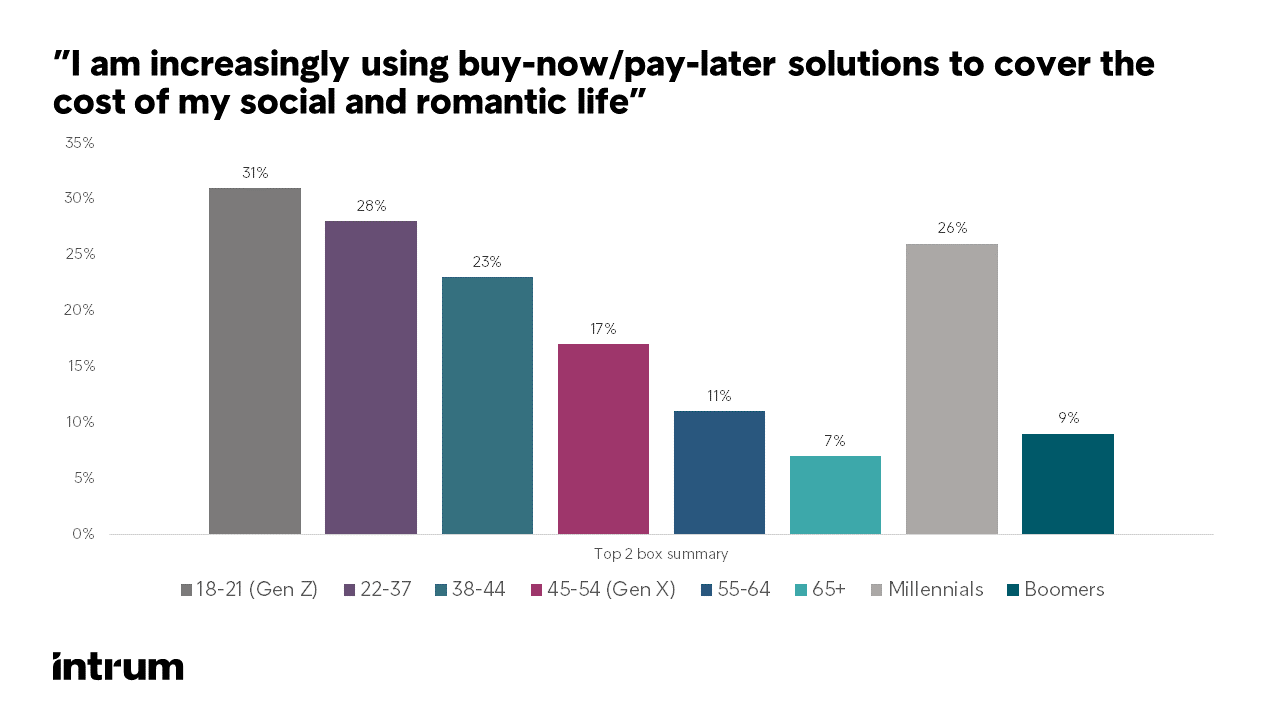

Worryingly, younger consumers are also more likely to use buy-now/pay-later solutions to fund their social and romantic life. While this payment method is growing in popularity and can work well for some purchases, there is a danger that they are building up debts they will struggle to repay down the line.

In truth, love doesn’t need to break the bank, and while some are getting carried away, others are cutting back on consumption. Two thirds of the 24,000 consumers we surveyed across Europe said they are planning to cut back on spending in light of difficult economic conditions. Four in ten of those say this means they are spending less money on gifts for others, while more than half (55 per cent) are reducing social activity, such as meals out.

So, how to celebrate without the financial heartache?

Mark Valentine’s Day your way – with more than a third of us feeling social media creates a pressure to spend more than we should, it’s easy to get carried away. Instead, avoid financial heartache by planning a celebration that fits you and your budget.

More consumer payment insights

The insights from this article are based on 2022's European Consumer Payment Report. Download a free copy today to get pan-European consumer payment insights.