Ready to retire or coming up short?

With living costs rising, it’s becoming increasingly difficult for many of us to keep on top of our finances. So, saving for retirement has taken a backseat, as the tightening of the purse strings means less money to plan for the future.

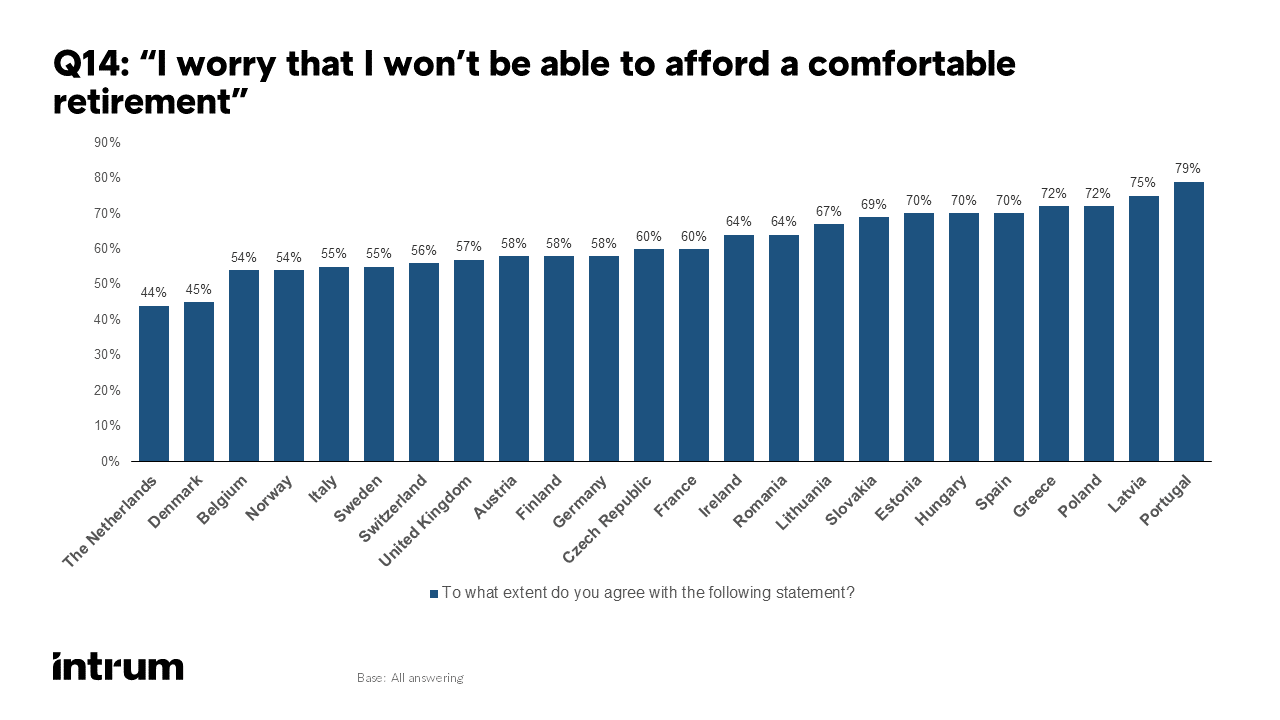

If you’re worrying about how to pay for your retirement years, you aren’t alone. On average, a whopping 62 per cent of European consumers worry that they won’t be able to afford a comfortable retirement.

In some countries, these figures are even higher. Consumers in the southern European countries of Spain, Portugal and Greece are particularly worried about affording a decent standard of living in retirement, while those from Estonia, Hungary, Latvia, Lithuania, Poland and Slovakia also report higher levels of concern.

Retirement planning is, unfortunately, not something we prioritise, especially in the case of younger generations. However, our survey shows the fear of not being able to afford to retire comfortably is something many of us are worried about, especially those who see their parents struggling.Anna Zabrodzka-Averianov, Senior Economist at Intrum

Generational differences

Generation X (those aged between 45 and 54 years) are most concerned about their retirement funds, with seven in 10 worried they won’t be able to afford a comfortable retirement. This compares with 44 per cent of over 65s and 55 per cent of 18-21 year olds.

Despite this, only around a third (36 per cent) of us put saving for retirement in our top three reasons for saving. Unsurprisingly, this rises for older consumers, with 57 per cent of 55-64 year olds confirming that saving for retirement is a top three savings priority, compared with 23 per cent of Gen Z 18-21 year olds.

This is worrying, as saving early for retirement makes a huge difference to the funds available. Planning for retirement has also been gaining importance, considering that public pension schemes with compulsory contributions are becoming unsustainable due to ageing population trends across European countries. Consumers in Germany, Sweden and Switzerland are most focused on saving for retirement. At least a fifth of survey respondents rated saving for retirement as their number one savings priority in those countries.

Inflation is also a concern for consumers in Europe, with 71 per cent worried that inflation will reduce the value of cash savings. It is true that inflation is likely to reduce retirement buying power, so it is wise to plan for prices to continue to rise.

How to make your retirement more comfortable

Budget so you know how much you need to live comfortably and talk to your spouse or partner about spending plans so you’re on the same page.

Poor health will increase your costs so stay active and try to be as healthy as possible.

If you are fit and able to work, even adding a couple of extra years to your working life can make a big difference to your retirement budget.

Check the tax-free allowance and make use of pension and savings schemes that enable you to save in a tax-efficient way.

Debt problems don’t go away on their own. If you’re struggling, talk to your creditors or seek independent advice to find a solution.

More consumer insights

The insights from this article are based on this year's European Consumer Payment Report. Visit intrum.com/ecpr2022/ to learn more.