Doing it for the kids – financial education in difficult times

As parents, we want the best for our children and setting them up with strong financial skills is important. But, are we also passing on bad habits and unfounded beliefs?

After decades of low inflation and interest rates, the economic crises of the past few years have rocked many people. Faced with increasing costs, parents in particular are feeling the pinch. They are also more likely to say their concerns about rising bills are affecting their wellbeing than those without children (64 per cent compared with 55 per cent).

Almost three quarters (72 per cent) of parents report that their household bills are increasing at a higher rate than their income – again higher than the population as a whole (68 per cent).

It’s not all doom and gloom. The knock-on effect of these difficult financial times is that parents have been motivated to ensure their children are prepared for the future.

Parents motivated to financially educate children

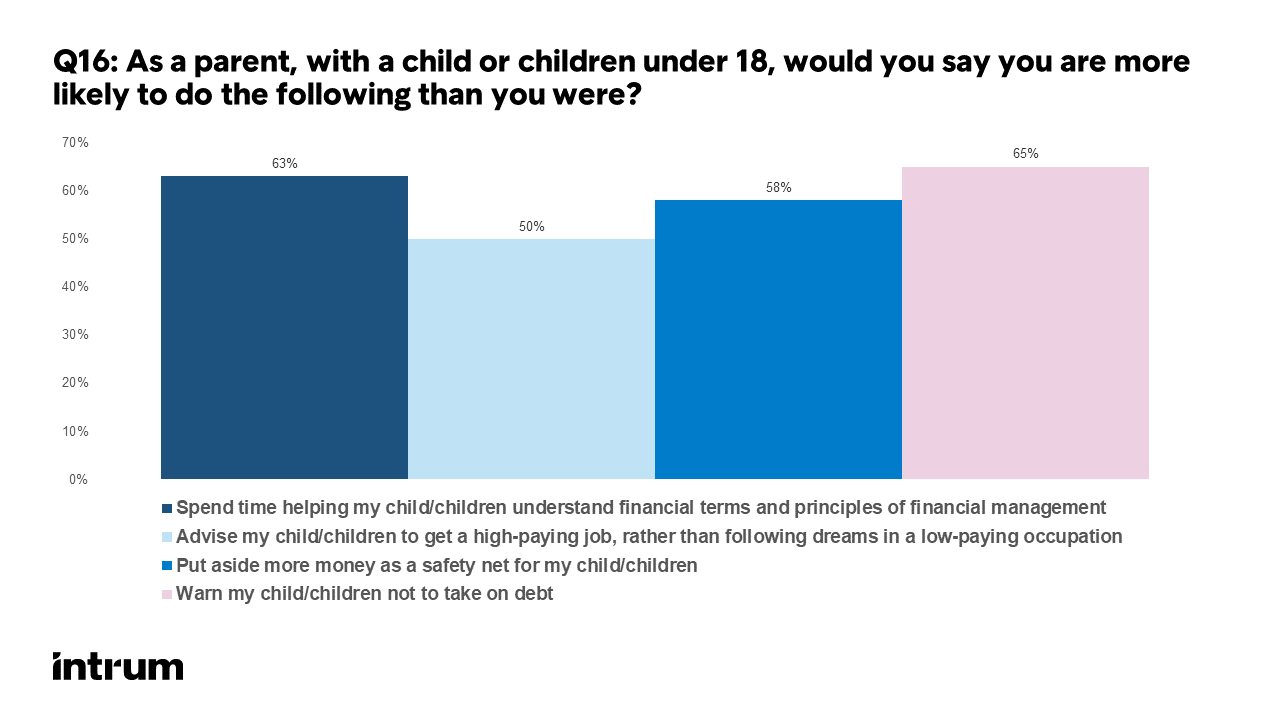

Our survey found that 63 per cent of parents are more likely to take the time to ensure their children understand financial terms and principles than they were in the past. This is an important foundation for children and will stand them in good stead in the future.

Six in ten parents (58 per cent) are also putting away more money as a safety net. Half say they will advise their child to look for a high-paying job instead of pursuing their dreams in a low-paying occupation.

In addition, two thirds (65 per cent) of the parents we surveyed say they will warn their child not to take on debt. While problem debt is absolutely to be avoided, it’s important not to scare children when it comes to debt. Used wisely, debt actually helps society function.

So, what should we be telling our children?

Here are some tips that will help your children manage their money and avoid problem debt…

-

Learn to budget – this is a key skill that will serve children into adulthood. Teaching them how to manage money means knowing how much they have coming in and what they need to spend it on. You don’t have to wait to start; even very young children can use pocket money to save and spend.

- Don’t ignore problems – one of the biggest issues with problem debt is that people are afraid to face the issue and put off seeking help. Debt problems never go away on their own. As they become teenagers and take control of their spending, use any money mistakes as a learning experience and emphasise they should always speak up and ask for help if they need it.

- Understand what debt means – not all debt is the same. Student debt enables education, mortgages allow us to buy homes and many businesses have been funded with debt. However, some types of debt are more expensive than others and, whatever kind of borrowing you engage in, it’s important to have a plan to pay it back. Being afraid of debt will paralyse a child – it’s far better that they understand how it works and the consequences of not being able to pay back what they owe.

- Save for a rainy day –saving is a skill that is well worth developing at an early age. Young children can save pocket money for a bigger treat or toy, and this will teach them the value and satisfaction of saving. As they get older, they’ll be used to not spending every penny they have, and this will enable them to build a savings cushion.

- Be open – children learn from their parents so don’t be secretive about money. Answer their questions on spending, saving and debt so they have the tools and knowledge they’ll need as adults. Model good financial behaviour and they’ll be likely to follow.

Consumer payment behaviour insights

These insights are based on Intrum's European Consumer Payment Report 2022. Download the report for even more pan-European payment behaviour insights today.