Financial equality – don’t let gender hold you back

Are discrepancies in financial education between men and women down to knowledge or confidence? On International Women’s Day, we ask if women are still falling foul of gender expectations when it comes to managing their money.

The difficult economic situation is causing many of us to tighten our belts. However, it seems that women are worrying more than men about their finances.

In Intrum’s annual survey of more than 24,000 consumers across Europe, almost two thirds of women (62 per cent) said their concerns about rising bills are having a negative impact on their wellbeing – compared with 54 per cent of men. Women also reported higher levels of concern about rising interest rates and prices.

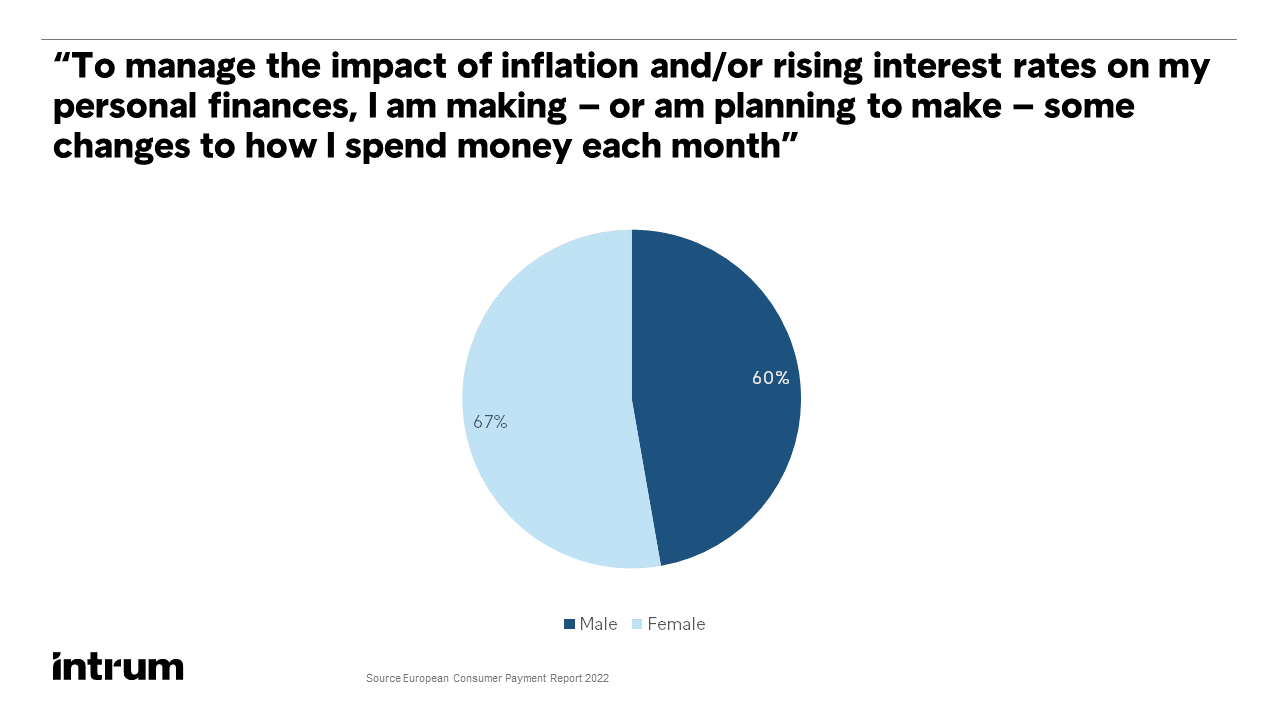

More women (67 per cent) than men (60 per cent) said they were planning to make changes to their spending to manage the impact of inflation and rising interest rates.

Knowledge or confidence?

While plans to economise in difficult times suggests women are managing their finances carefully, men were more likely to correctly answer a question about the impact of inflation (51 per cent of men, compared to 40 per cent of women). This suggests they have greater understanding, making them better equipped to weather economic storms.

However, this is not necessarily the case. The gap between the two includes a larger number of women selecting ‘don’t know’ from the list of response options. This raises the possibility that some male respondents could be guessing the answer rather than admitting to a lack of knowledge.

Research shows that women tend to disproportionately respond ‘do not know’ to questions measuring financial aptitude, but often choose the right answer when this option is unavailable.

Asking for a pay rise

Assumptions about gender roles could also be negatively affecting women’s exposure to financial terms or products, which in turn affects their likelihood of investing2 or even asking for a pay rise.

There is evidence of this in the research, with 35 per cent of men saying they will request a pay increase in the next year, compared with 26 per cent of women. This is despite women being more likely to say their bills are increasing at a higher rate than their income (71 per cent compared to 65 per cent of men).

The gender gap persists in Europe and has barely changed in the last decade. A greater focus on financial education for women and girls could help play a role in improving economic equality.Vanessa Söderberg, Global Sustainability Director at Intrum

Ready for retirement

Getting financial education right is important so that women can plan their financial futures confidently. According to Intrum’s research, two thirds of women (66 per cent) worry that they won’t be able to afford a comfortable retirement, compared with 57 per cent of men. A similar number of women (64 per cent) are also dissatisfied with the amount of money they are able to save each month – something 58 per cent of men feel.

Make sure you’re on top of your finances. Here are some things you can do to improve your finances this International Women’s Day…