Financial education pays off

Consumers with good financial education are better able to withstand the economic downturn and are more optimistic about the future, according to Intrum’s latest research.

The pandemic and the ongoing economic crisis have made many of Europe’s consumers determined to improve their financial understanding. That’s good news, given that evidence shows those with a strong level of financial education are more likely to weather the downturn and less likely to feel despairing about their financial future.

Intrum’s 2022 European Consumer Payment Report, a survey of 24,000 consumers across Europe, shows a clear correlation between consumers’ level of financial education and their resilience to the economic downturn.

Those with an elevated level of financial education report higher levels of financial wellbeing and are significantly less likely to default on their bills, compared with those who say they received poor financial education.

For example, one in two (49 per cent) with a poor financial education – in that they consider this education to have been insufficient for them to manage day-to-day financial matters – expects to default on a utility bill at least once in the next 12 months, compared with just 29 per cent of those with good financial education.

View of the future skewed by education

Around seven in 10 respondents with a poor financial education indicate that they are worse off now than they were 12 months ago. This compares with less than half (48 per cent) of those whose education has made them confident in their understanding.

These customers are also more likely to have a bleak outlook on the future, with 23 per cent believing, without good cause, that there will never be an end to the current period of high inflation. Further, those with poor financial education are more likely to be worried about high interest rates without understanding how they could be affected – 59 per cent said this, compared with 47 per cent in groups with sufficient knowledge.

In today’s economy, consumers who cannot understand how interest rates or inflation work will struggle, especially with late-payment fees rising. But these findings also indicate that initiatives to strengthen financial education could be one way to limit future financial difficulties.Anna Zabrodzka-Averianov, Senior Economist at Intrum

Consumers striving to improve education levels

More than half of the consumers questioned are now actively striving to broaden their understanding of personal finance, and respondents’ knowledge of key terms has improved since last year. Around two in three (64 per cent) could identify the correct definition of inflation, for example, up from 58 per cent in 2021.

However, 54 per cent cannot give the right answer to a question about how inflation could affect a hypothetical energy bill over a two-year timeframe. The consumers most likely to get the question right were 55-64 year olds – 48 per cent gave the right answer, compared with 41 per cent of 18-24 year olds, suggesting age and experience go hand in hand on financial matters.

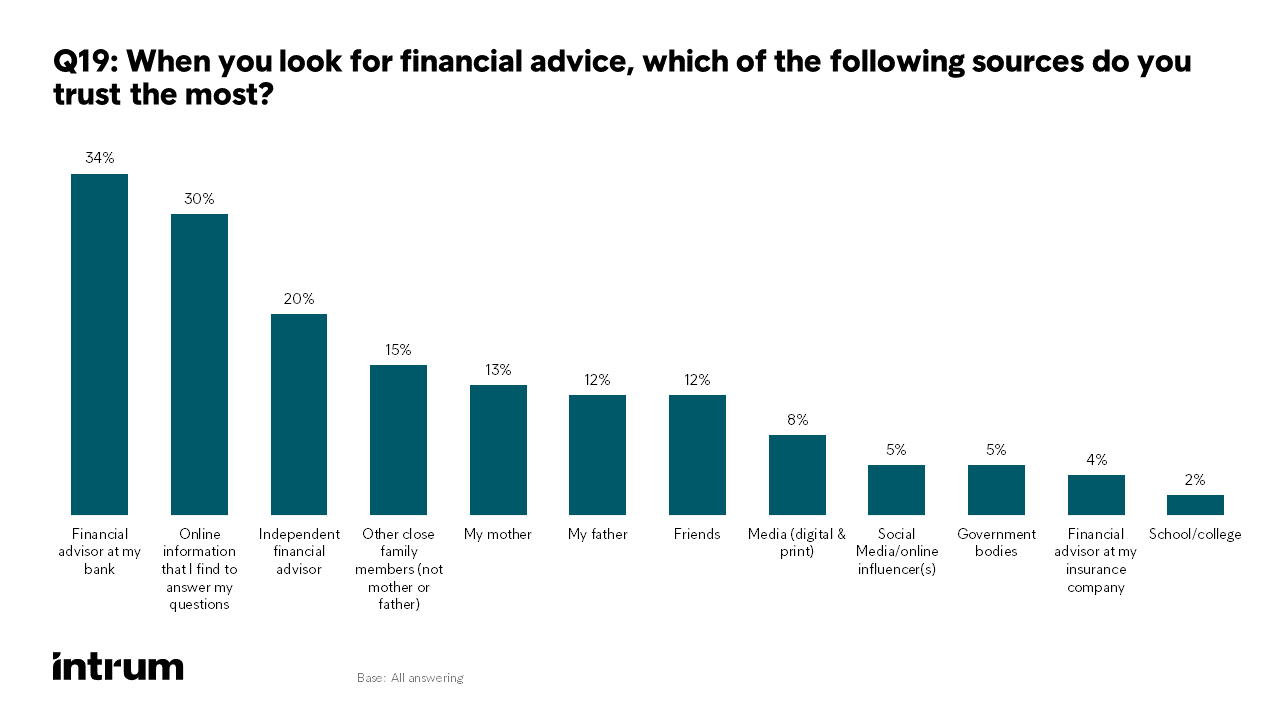

While almost two thirds of parents (63 per cent) say they are more likely to spend time helping their children understand financial terms and principles of financial management than they were, those same consumers don’t necessarily value their own parents as a source of advice. Very few said they trust their mother or father most when it comes to their finances (13 and 12 per cent respectively).

Gender financial education gap?

Men were more likely to correctly answer a question about the impact of inflation than women (51 per cent compared with 40 per cent). However, women were more likely to select the answer ‘don’t know’, suggesting some male respondents could be guessing rather than admitting to a lack of knowledge.

This reflects recent research showing that women tend to disproportionately respond ‘do not know’ to questions measuring financial aptitude, but often choose the right answer when this response option is unavailable.

Men are also more likely to request a pay rise than women – 35 per cent versus 26 per cent – despite women being more likely to say their bills are increasing at a higher rate than their income (71 per cent compared to 65 per cent of men).

Given that the gender pay gap in Europe has changed only minimally in the last decade, a greater focus on providing financial education to women and girls could play a role in improving economic equality.Zabrodzka-Averianov

Read the full report

For more information and a copy of the 2022 European Consumer Payment Report, visit intrum.com/ecpr2022