25.07.2025

Intrum expands AI-native collections platform to Portugal and Italy

Ophelos, Intrum’s AI-native collections platform, is now live in eight European markets, with Portugal and Italy the latest to join.

This marks another significant step in Intrum’s journey to becoming a tech-driven credit management company. With each new market, we strengthen our ability to resolve debt with greater empathy, efficiency and intelligence, and deliver consistent value to our clients and customers across Europe.

The rollout in Portugal and Italy follows successful implementations in the UK, the Netherlands, France, Belgium, Spain and Ireland. Next up are Greece, Germany and Sweden, with all three markets set to go live in 2025.

Expanding Ophelos across Europe is not just about technology – it’s about redefining how debt resolution works. We’re improving customer experiences, enabling smarter operations, and setting a new industry benchmarkAmon Ghaiumy, Head of Product Development

What is Ophelos?

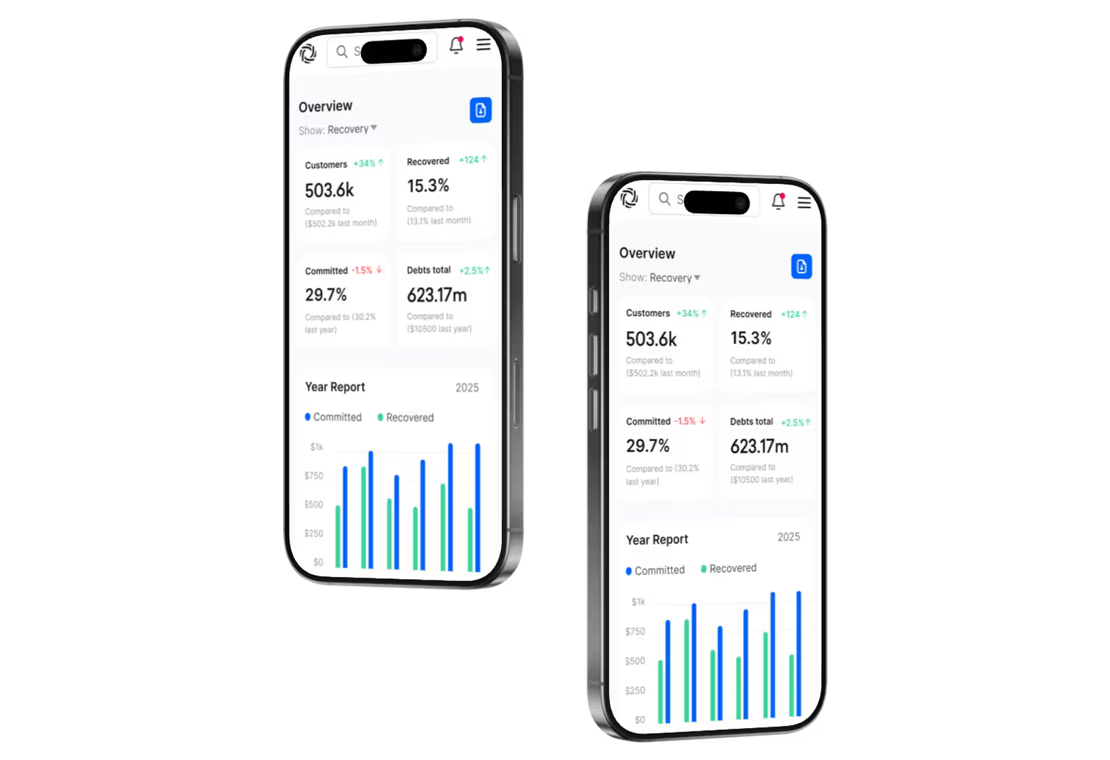

Ophelos is Intrum’s AI-native debt resolution platform. It combines automation, behavioural science and advanced analytics to create personalised, digital-first journeys that help consumers resolve their debts faster and with less friction, while delivering operational efficiencies for clients.

Built in-house by a cross-functional product and engineering team, Ophelos is designed to integrate seamlessly across markets while adapting to local needs and regulatory environments.

Why it matters

With Ophelos, Intrum is redefining collections by putting the customer at the centre, using advanced technology to provide flexible, human-centric digital journeys that adapt to people’s circumstances.

Each market launch accelerates this transformation. By embedding AI into our operations, we’re not only improving the experience for consumers, we’re also increasing consistency and scalability for our clients, and provide a more sophisticated, data-driven approach to debt resolution, improving engagement rates and recovery outcomes while providing unmatched analytical insights.

Ophelos supports Intrum’s broader ambition to deliver a new standard for collections across Europe — one that is intelligent, inclusive and respectful.’

“The launch in Portugal and Italy reflects our commitment to scaling innovation across Europe, ensuring that both clients and consumers benefit from a more consistent, intelligent and empathetic approach to debt resolution” said Amon Ghaiumy, Head of Product Development.

Looking ahead

As Ophelos continues to scale, Intrum remains focused on embedding AI capabilities deeper into its credit management operations — helping millions across Europe achieve financial recovery in smarter and more sustainable ways.