The International Day of Families 2019: One in four European families under financial strain

The International Day of Families, which takes place on May 15 each year, spread awareness of the social, economic and demographic changes that are affecting families worldwide. Although the family as a unit may have changed in the past quarter of a century, one thing remains a key issue: personal finances.

The latest European Consumer Payment Report (ECPR), a survey of the financial habits and concerns of over 24,000 people by leading credit management company Intrum, found that more than one in four European parents (27 per cent) is financially struggling to support their children’s needs.

Parents borrow money to buy something for their children

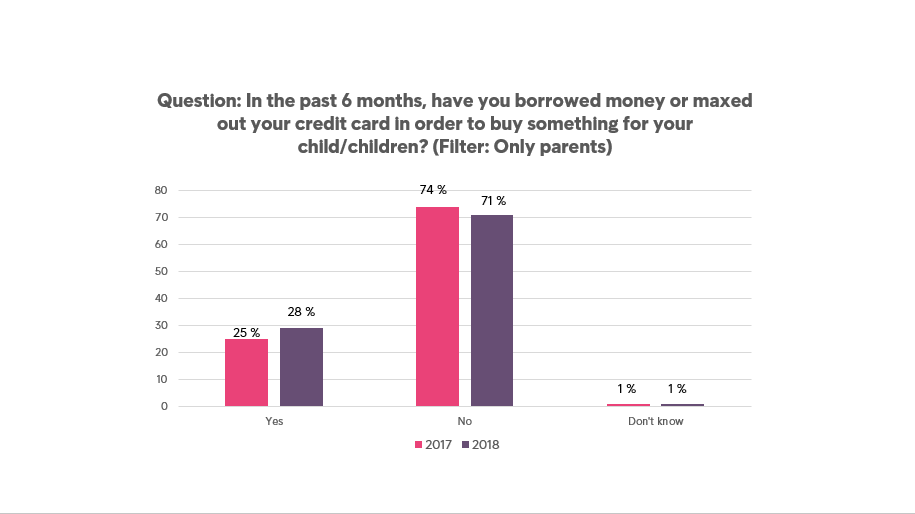

Growing consumer phenomena such as easier online shopping and pressure from social media to keep up with the latest fashions--especially on teenagers and pre-teens--has been a factor in making the number of people that borrow to pay their bills climb from 15 to 20 percent from 2017 to 2018. Families make up a substantial share of this group: 28 percent of parents say they have borrowed in order to buy something for their kids.

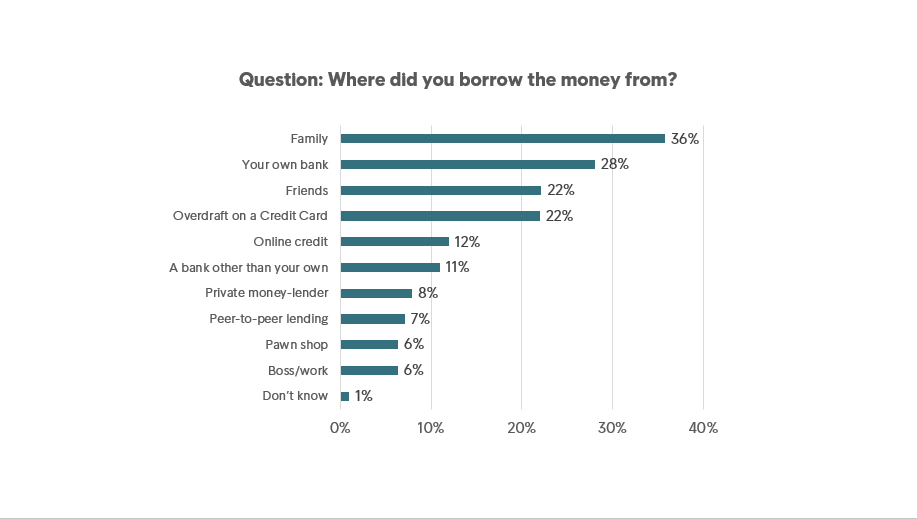

Other findings that directly affect family life are the fact that unofficial loans are a big part of the European economy. So much so, the ECPR found that as many as 36% of Europeans borrow money from family.

The education system should play a larger role in teaching children about finances

With all of these findings in mind, it’s perhaps no surprise that close to three out of four parents who were took part in the report’s survey believe that the education system should play a more prominent role in teaching their children about finances, although eight out of ten say that they themselves already try to provide guidance to their kids.

As we mark the International Day of Families, the European Consumer Payment Report shows that we need to put more focus on the growing number of consumers who are facing financial struggles. Financial education is a vital ingredient in meeting this challenge, as is a commitment to ensuring responsible use of credit and timely repaymentsAnna Fall, Chief Brand and Communication Officer, Intrum.

About the survey:

Intrum has gathered data from 24,398 consumers in 24 European countries to gain insights in the European consumers’ everyday life; their spending and ability to manage their household finances on a monthly basis.