Debt investors

Intrum AB’s (publ) Group Treasury aims to secure a diversified funding base to assure access to funds and support the Group’s business opportunity.

Financing policy

Intrum AB’s (publ) Group Treasury aims to secure a diversified funding base to assure access to funds and support the Group’s business opportunity. Financing is to the extent possible made in local currency to minimize currency effects in the P/L, and in combination with currency borrowings, financial derivatives is used to match Intrum AB’s assets. The Treasury activities are centralized to manage the cash, exploit economies of scale and optimize the Group’s financial net as efficiently as possible. All financial transactions are carried out within risk mandates and limits established by the board.

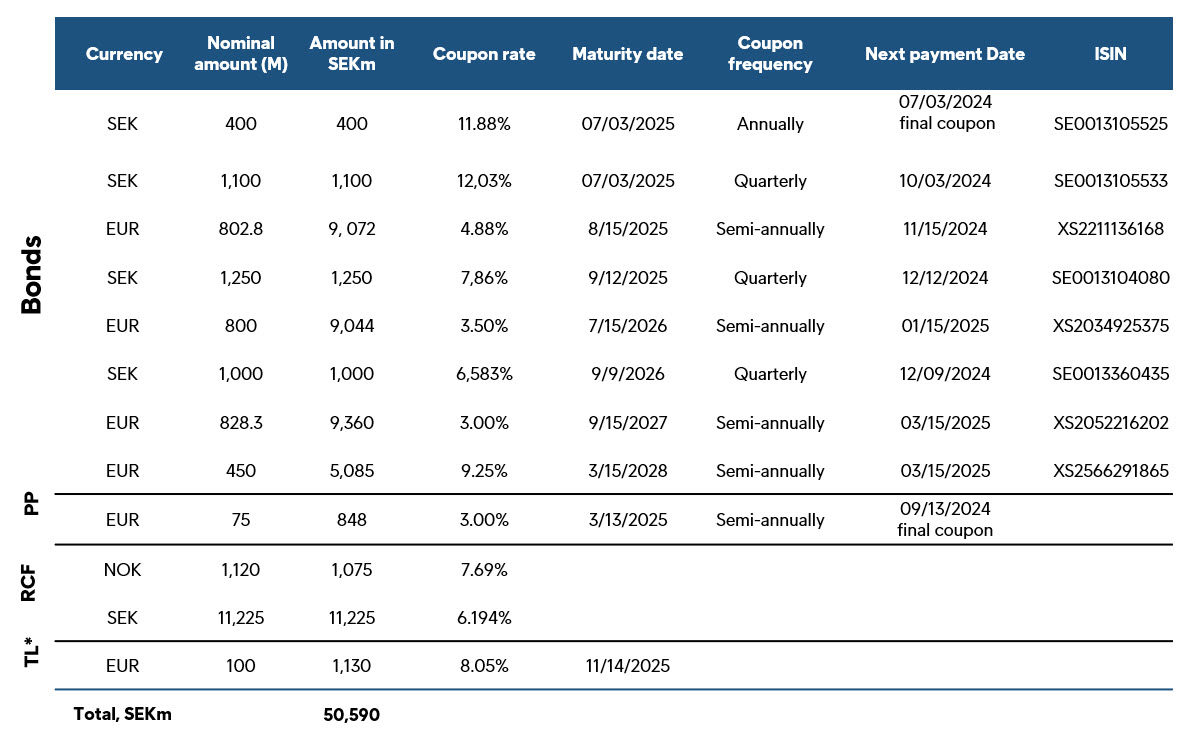

Further to the funding sources mentioned below Intrum AB has a syndicated Revolving Credit Facility (RCF) of EUR 1.8bn. The RCF will be used for general corporate purposes including portfolio purchases and smaller M&A transactions.

Intrum AB regularly seeks access to a diverse funding sources and hence, from time to time, utilizes bilateral funding opportunities. For the latest update on Intrum's funding base, please refer to the interim investor presentation downloadable here.

Debt related press releases

Credit rating

A Credit Rating is an assessment of a company’s ability to fulfill its financial obligations. To maintain a robust financial platform for growing and supporting Intrum AB’s (publ) business, an external rating is a necessity in the international financial markets to attract funds at attractive levels. Intrum AB (publ) is in regular contact with the credit analysts of the agencies to give an accurate picture of Intrum AB’s (publ) credit and business outlook.

Our approach to Sustainability

Strong performance in leading ESG ratingsMaturity profile

Bonds

| Maturity | ISIN | Coupon | Listing |

|---|---|---|---|

| 2024 | XS1634532748 | 3,125% | Irish Stock Exchange |

| 2025 | XS2211136168 | 4,875% | Luxembourg Stock Exchange |

| 2026 | XS2034925375 | 3,500% | Luxembourg Stock Exchange |

| 2027 | XS2052216202 | 3,000% | Luxembourg Stock Exchange |

| 2028 | XS2566291865 | 9.250% | Luxembourg Stock Exchange |

Swedish MTN Program

Since February 2012 Intrum AB (publ) has issued bonds on the Swedish market under a MTN (Medium Term Note) Program, which has a maximum total allowance of SEK 10 billion. The bonds are listed on Nasdaq Stockholm

Notice to noteholders’ meeting under the Swedish MTN Program

- Intrum AB - Notice to Noteholders' Meeting (English in-house translation) - Loan 111 (ISIN SE0013104080)

- Intrum AB - Notice to Noteholders' Meeting (English in-house translation) - Loan 113 (ISIN SE0013360435)

- Intrum AB - Notice to Noteholders' Meeting (English in-house translation) - Loan 114 (ISIN SE0013105525)

- Intrum AB - Notice to Noteholders' Meeting (English in-house translation) - Loan 115 (ISIN SE0013105533)

- Proposed Amended General Terms & Conditions for Loan 111 & 113 issued under Intrum AB's Swedish MTN Programme

- Proposed Amended General Terms & Conditions for Loan 114 & 115 issued under Intrum AB's Swedish MTN Programme

Kallelse till fordringshavarmöten under MTN programmet

- Intrum AB - KALLELSE TILL FORDRINGSHAVARMÖTE - Lån 111 (ISIN SE0013104080)

- Intrum AB - KALLELSE TILL FORDRINGSHAVARMÖTE - Lån 113 (ISIN SE0013360435)

- Intrum AB - KALLELSE TILL FORDRINGSHAVARMÖTE - Lån 114 (ISIN SE0013105525)

- Intrum AB - KALLELSE TILL FORDRINGSHAVARMÖTE - Lån 115 (ISIN SE0013105533)

- Förslag till Ändrade Allmänna Villkor för Lån 111 och 113 upptagna under Intrum ABs Svenska MTN Program

- Förslag till Ändrade Allmänna Villkor för Lån 114 och 115 upptagna under Intrum ABs Svenska MTN Program

Intrum Updated MTN Prospectus

- Prospectus 2023-05-03

- Supplementary prospectus 2023-02-02

- Supplementary prospectus 2022-11-02

- Prospectus 2022-05-03

- Prospectus 2021-06-04

- Prospectus 2020-05-22

- Prospectus 2019-07-03

- Prospectus 2019-06-12

- Supplement 2018-06-25

- Prospectus 2018-05-30

- Prospectus 2016-06-03

Final Loan Agreement

- Final loan agreement 115

- Final loan agreement 114

- Final loan agreement 113

- Final loan agreement 112

- Final loan agreement 111

- Final loan agreement 110

- Final loan agreement 109

- Final loan agreement 108

- Final loan agreement 107

- Final loan agreement 106

- Final loan agreement 105

- Final loan agreement 104

- Final loan agreement 102

Commercial Paper

Intrum AB (publ) has the possibility to raise 4 BSEK in short term funding under its commercial paper program as a way to diversifying the base of our capital structure, lower the funding cost and for liquidity management.