Financial facts

Including key figures, financial overview, definitions and restated figures

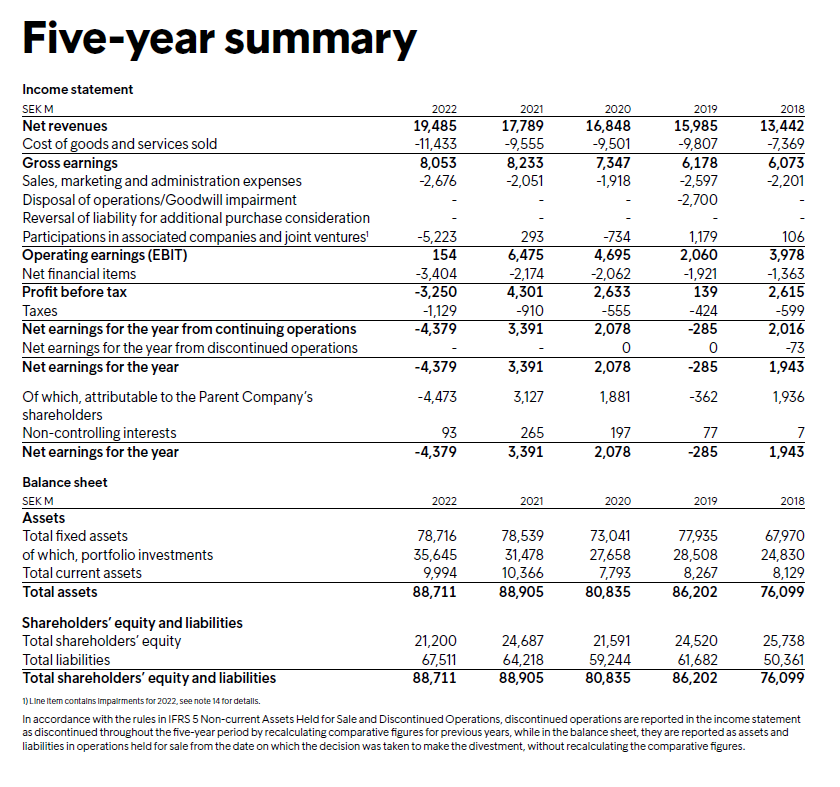

Full year 2022:

- Cash revenues increased to SEK 24,627 M (22,215)

- Adjusted EBIT decreased to SEK 6,664 M (7,014)

- Cash EBIT amounted to SEK 6,344 M (6,343)

- Cash EPS was SEK 24.76 (28.98)

- Cash RoIC decreased to 8.4 per cent (8.9)

- Net debt/full year cash EBITDA stable at 4.0x (3.9x)

- The Board of Directors of Intrum AB proposes that the Annual General meeting distributes a dividend to the shareholders of SEK 13.50 (13.50) per share payable in two equal instalments in May and November 2023, corresponding to a total of SEK 1,627 M (1,632).

Definitions

Restated figures

Restated figures from our new segment structure for our credit management services

Historical quarterly figures for 2011 and 2010 in which the operating results for Credit Management and Financial Services have been recalculated in accordance with the new principle. Published 2012.03.27.

Financial and other information related

In connection with its announced combination with Lindorff, Intrum Justitia has made available certain financial and other information concerning Intrum Justitia, Lindorff and the combined group. Published 2017.06.12

Historic pro forma financials for Intrum Justitia and Lindorff

In order to provide further information on the combination of Intrum Justitia and Lindorff, historic proforma financial development for the combined unit is available here. Published 2017.07.14