Festive finances: don’t start 2023 with a debt hangover

With Christmas right around the corner, many of us are already shopping for gifts and stocking up on food for the festive season. It’s easy to get carried away in the tinsel and mistletoe, but if you spend more than you can afford you could start 2023 with a debt hangover.

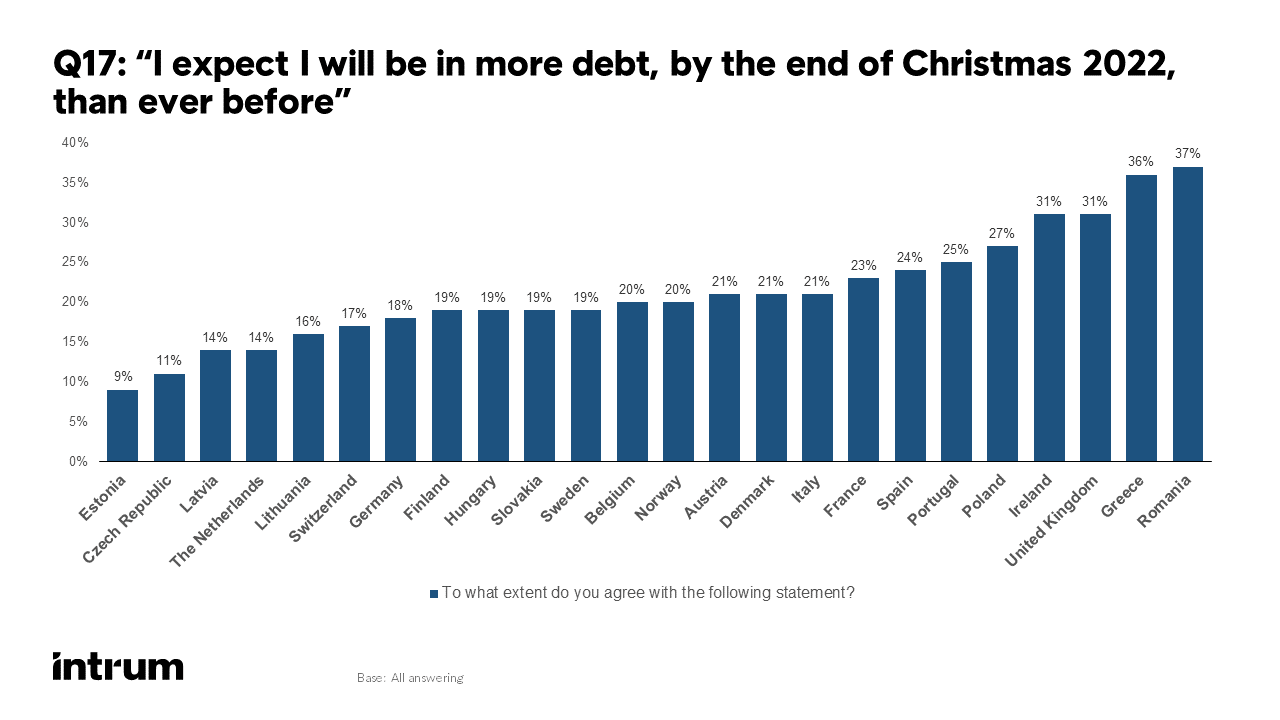

According to our research, more than a fifth of European consumers expect they will be in more debt than ever before by the end of Christmas.

In some countries this figure is even higher: in Greece and Romania more than a third (36 per cent and 37 per cent respectively) feel this way, while in the UK and Ireland 31 per cent of consumers believe Christmas spending will tip them into more debt than they have ever experienced.

This fear is closely linked to feeling pressure to take on debt to keep up with expectations. On average, 16 per cent of consumers told us they take on a lot of debt at Christmas to pay for presents and food because it keeps their family together and is expected of them. Those in the UK, Spain, Ireland, Greece and France are most likely to borrow to fund Christmas plans.

But there are signs that we may be tired of Christmas overspending, for environmental and financial reasons. Four in ten consumers say they are uncomfortable about the level of unnecessary waste at this time of year, suggesting many would be happy to scale back their spending.

At Intrum we believe it is possible to have a wonderful Christmas without putting yourself in financial difficulty.

Here are some tips for protecting yourself financially

Know how much you have to spend and stick to the plan.

If money is tight this year why not talk to friends and family and agree not to buy gifts, or to do a ‘secret santa’ or token gift? You won’t be the only one struggling.

You don’t have to splash money around to spend quality time with family and friends – prioritise people over possessions.

If you do borrow money to fund Christmas, make sure you have a sensible and achievable repayment plan in place.

If you are in financial difficulty, speak up sooner rather than later. Talk to your creditors or seek independent advice to help you tackle the issue.

With concerns about rising bills having a negative effect on well-being for six in ten consumers, know that you aren’t alone in juggling finances. Don’t let Christmas be a cause for stress. At Intrum we are always here to help.

Get more insights

The insights from this article are based on this year's European Consumer Payment Report. Visit intrum.com/ecpr2022/ to learn more.