Young consumers choose online advice over traditional banks

As Global Money Week encourages young people to build their future and be smart about money, we consider where young consumers are turning for trusted financial information and what they are teaching their older peers about the power of financial decisions.

The Global Money Week, taking place 21st to 27th of March, is an annual global awareness-raising campaign on the importance of ensuring that young people, from an early age, are financially aware, and are gradually acquiring the knowledge, skills, attitudes and behaviours necessary to make sound financial decisions and ultimately achieve financial well-being and financial resilience.

The Covid-19 pandemic hit consumers hard, causing many to focus on financial education and advice. At the time of writing, the Russian invasion of Ukraine has very much clouded the near-term outlook of the European economy. In the aftermath of the global crisis, many are making long-term savings and investment plans as well as talking to their friends and family about money.

But who do consumers most trust to provide the information and support they need?

According to Intrum’s 2021 Consumer Payment Report, the overall most trusted source of advice for European consumers is their bank – 37 per cent said this is the case.

Almost a third (29 per cent) said they rely on information they find online, while 25 per cent cited an independent financial adviser. Others said they trust their family and friends the most.

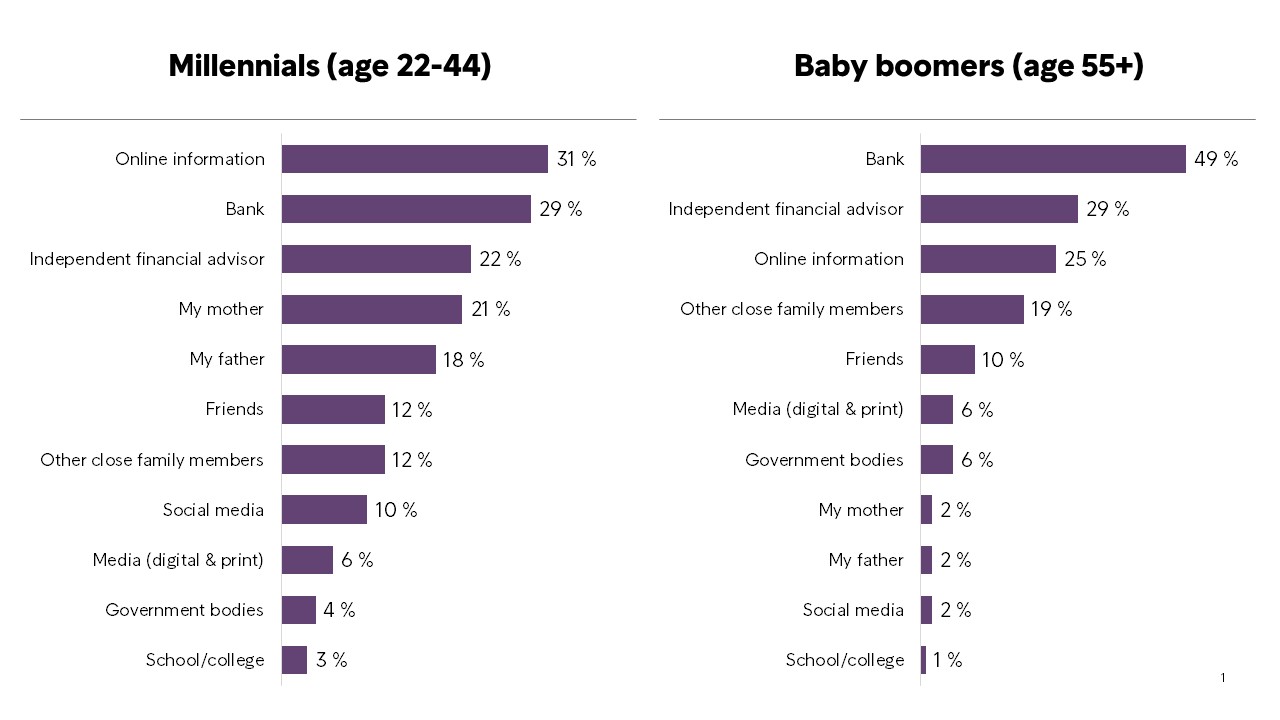

Q: When you look for financial advice, which of the following sources do you trust the most? (split by age groups):

However, when it comes to younger consumers, online and social media options rank more highly. Millennials say that online information is their number one, while Baby Boomers still place their bank and financial adviser at the top of the list.

In addition, 10 per cent of Millennials see social media as a trusted source, compared with only two per cent of older consumers.

Schools and colleges fail to make the grade

Despite the fact that 82 per cent of European consumers said they received excellent or sufficient financial education, schools do not score highly for financial advice.

In fact, schools and colleges were the lowest rated as a source of trusted financial information – only two per cent of respondents choose them and only three per cent of Millennials. This suggests there is far more to do to embed financial education in the mainstream education system.

The fact that schools rate so low when it comes to trust in this area demonstrates the common gulf between general education and financial advice. Most people simply do not see schools and colleges as trusted sources of information when it comes to their finances.Intrum

Meanwhile, there is more to do to spread financial literacy across Europe. One crucial element is for consumers to be aware of their financial position. Many are keen to improve their financial awareness, but others are struggling to admit the extent of the problem.

Facing the facts on finance

Across Europe, one in six people say they don’t have control over their debt, but this rises to almost a quarter of those in the UK and Norway (24 per cent). Younger consumers are those most affected, with a quarter of 18-21 years olds saying they don’t even want to know how much they owe in total.

Hiding from debt is a sign young consumers are overwhelmed and afraid. It’s important that they understand the extent of their financial difficulties so they can seek help and take steps to resolve it. Every day we speak to 250,000 people and we know first-hand the relief that comes from getting to grips with the situation

Sustainability will affect financial priorities

Yet young people are also leading the charge when it comes to sustainability and spending. Millennial consumers are far more likely than those over sixty-five to limit their spending for sustainability reasons (21 per cent said they are thinking this way, compared with six per cent). In addition, 42 per cent of Gen Z consumers said they would feel no guilt about paying a company later than agreed if they felt the company was unethical.

As well as older generations educating younger on financial behaviour, the younger generations are changing the way business is conducted. In future, financial education will be as much about ethical investment and practices as well as understanding how savings, interest and inflation work.